The FTSE 100 reached new highs over the past year, with the UK’s largest index starting 2024 on £7,733 and ending it 5.7% higher at £8,173.

It climbed higher still in the new year, soaring 6.1% to £8,673 by the end of January.

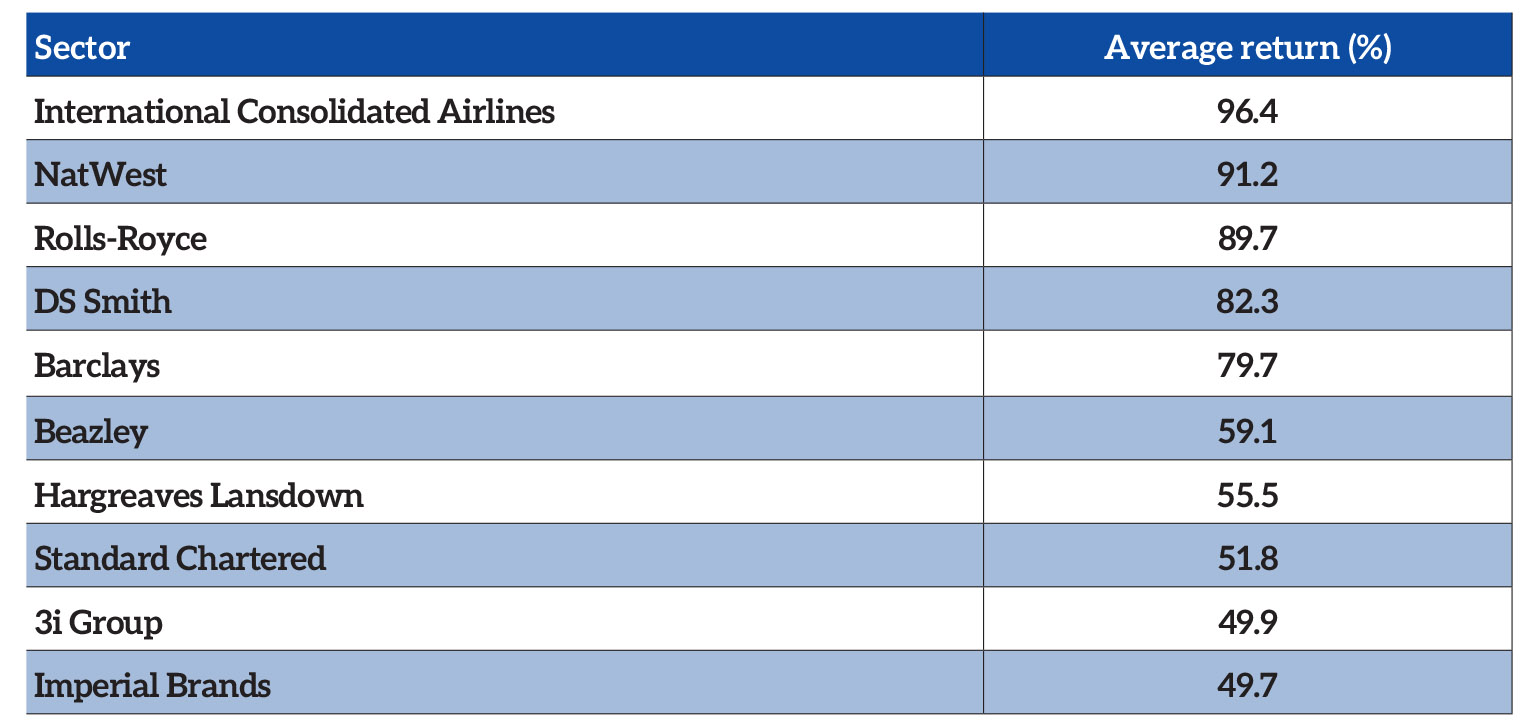

Some of the UK’s biggest companies grew their share prices substantially in 2024, while others detracted from the overall positive momentum with hefty downgrades.

The company to perform best last year was British Airways owner International Consolidated Airlines, which grew its share price by 96.4% throughout 2024.

The best performing FTSE 100 stocks in 2024

This was a long-overdue rebound following its downturn during Covid when airlines were worst hit by the pandemic, according to Dan Coatsworth, investment analyst at AJ Bell.

Its share price fell around 63% in 2020 as global travel restrictions stopped the aviation industry in its tracks, and International Consolidated Airlines struggled to recover since then. In the three years from 2021 to 2023, it lost another 3% before taking off again in 2024.

Coatsworth said: “The owner of British Airways is flying high after a delayed recovery in the travel sector post-pandemic has finally put its earnings and finances in a better shape.

“Revenue growth mixed with stronger margins has given a nice boost to profit and cashflow and continued International Consolidated Airlines’ journey in strengthening its balance sheet. That puts it in a stronger position to crank up shareholder returns or start thinking about acquisitions.”

Though the company’s recovery was overdue, it still came out of the blue. Most analysts had forecast €0.385 per share for 2024, yet it ended the year significantly higher at €0.531.

“It’s not often you see near-40% earnings upgrades for a stock in a year, but International Consolidated Airlines has done it,” Coatsworth added.

NatWest

Another UK giant to bolster its share price in 2024 was NatWest, which upgraded its earnings forecasts multiple times throughout the year. Shares in the company soared 91.2% after investors learnt of its improved margins and growth in its lending and savings deposits.

One major tailwind that helped boost NatWest was the large-scale sale of shares owned by the government. It came to the bank’s rescue during the 2008 global financial crisis and has owned a major stake in NatWest ever since.

At its peak, it owned as much as 84% of shares in the company, which it has gradually reduced over the years.

However, Chancellor Rachel Reeves accelerated the sale of these shares in 2024, bringing the government’s ownership down from 38% at the start of the year to 11%. She has indicated that the government will completely exit by the end of 2025.

Coatsworth said NatWest’s resilience since its 2008 lows beat market expectations, with few analysts anticipating the bank to survive and become the stalwart it is today.

“A decade ago, everyone was talking about challenger banks eating the legacy players’ lunch, yet NatWest is one of the big banks to have shaken off this competition,” he explained. “It has found ways to run the business more efficiently and growth has more recently been augmented by the acquisition of assets from Sainsbury’s Bank and Metro Bank.

“For a sector that is often mired in mis-selling scandals and the ever-increasing weight of regulation, it feels as if NatWest has shown that banks are still capable of doing well. It’s no wonder investors have been happy to keep bidding up the shares.”

Rolls-Royce

Another beneficiary of an upswing in aviation was Rolls-Royce, which was inundated with new contracts as recovering airlines expanded their fleets and added new flight routes.

Upgraded earnings forecasts boosted its share price 89.7% in 2024, making it “a true phoenix from the ashes” after years of disappointing cash flows, according to Coatsworth.

“Warren East laid the foundations for running a tighter ship at Rolls-Royce, but his successor Tufan Erginbilgiç is the one basking in all the glory for this grand turnaround,” he added.

Increased government spending on defence has also boosted Rolls-Royce’s prospects, as has Labour’s positive stance on nuclear power.

The company seems to be going from strength to strength, but it is now under pressure to deliver if it wants to justify its elevated share price, according to Coatsworth.

“The growth opportunities are big and the company is on a roll, so it is understandable why investors might feel they want to stick with the shares even after a near 740% rise since October 2022,” he said.

“Smashing expectations with its half-year results in August went some way to justifying its premium share rating, but it also means this feat has to be repeated again and again, otherwise investors might take anything less as a reason to bank their profits.”

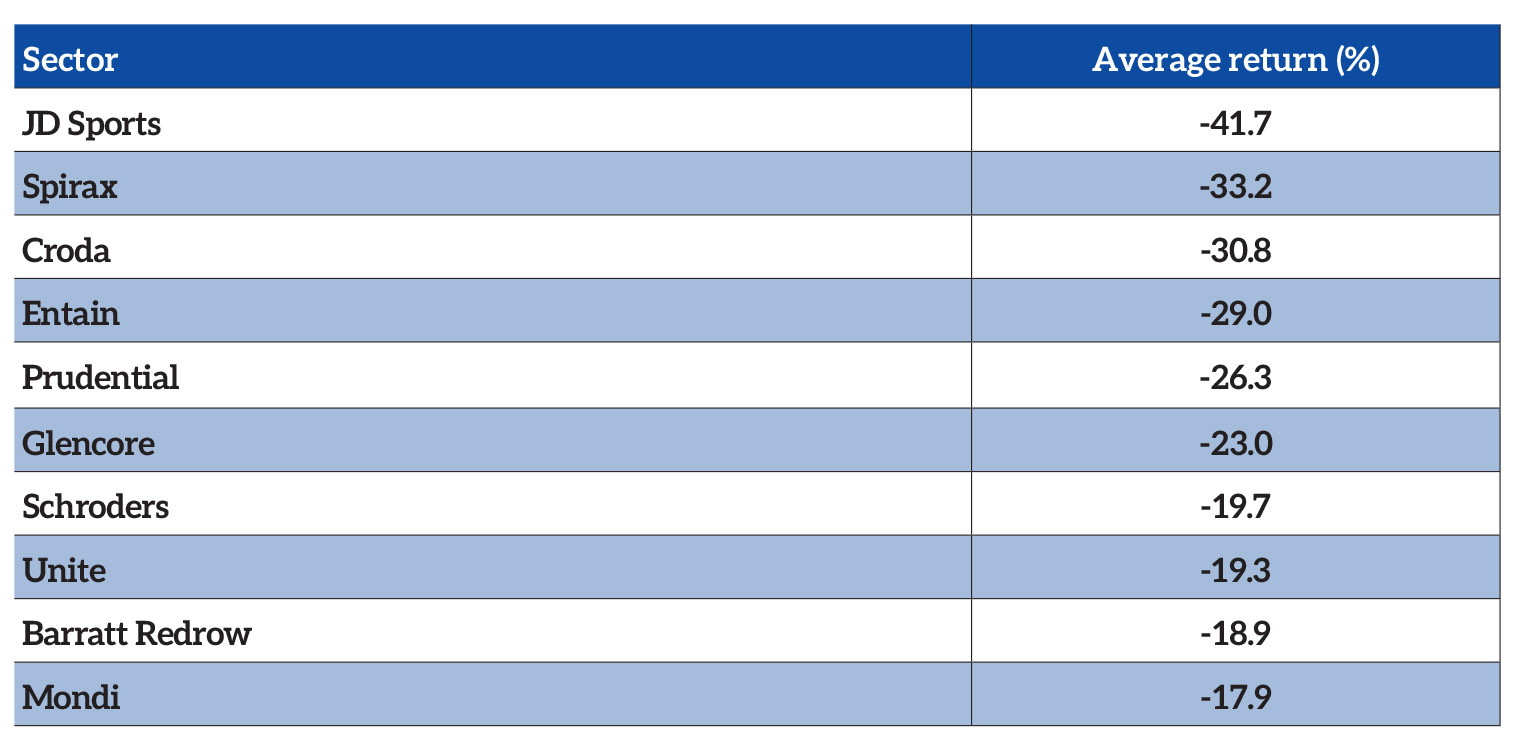

The losers – JD Sports

While some FTSE 100 constituents soared in 2024, other UK giants spiralled. One such company was JD Sports, which saw its share price drop 41.7% throughout the year.

It started 2024 on the backfoot, with a post-Christmas profit warning sending its shares falling 27.6% in the first week of January.

It recovered gradually up until August, until poor sales reports in the UK, the Americas and Asia Pacific sent the share price tumbling even further.

The worst performing FTSE 100 stocks of 2024

Coatsworth said these poor sales could be a short-term headwind as consumers become more conscious of spending – or it could be the early symptoms of a more systematic decline for JD Sports.

“What was a trusted name in retail is now churning out more excuses than a schoolboy who hasn’t done their homework,” he said.

“Cracks have appeared in the athleisure market this year as consumers become more selective over where they spend money. Previously, they might have been happy to splash the cash on the latest must-have trainers but for many people footwear is now having to last longer before replacement.

“Similar trends have been seen in sporty clothing. Investors need to decide if this is a short-term blip or the new normal.”

This story was written by our sister title, Portfolio Adviser