In recent years, a lot of coverage has been given to the struggles of US expats abroad, from reporting conditions under the Foreign Account Tax Compliance Act (Fatca), to hurdles faced when renouncing US citizenship, to being refused financial services abroad.

But when the tables are turned, what are the needs of expats that relocate or retire to the US? What should they consider before moving to the United States and how is their tax planning and situation different?

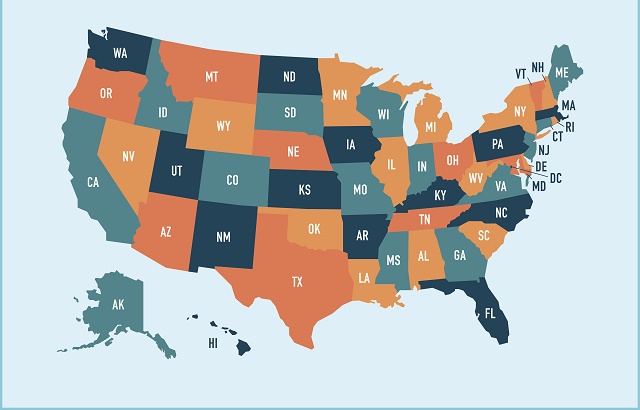

The US undoubtedly has a very different structure to most countries since every single state can legislate their own set of rules, taxes and requirements, which can make it harder to navigate.

As a result, International Adviser spoke with London & Capital about how people can prepare before crossing the Atlantic.

Stay or go?

Robert Paul, partner and head of US family office at London & Capital, said that there is one main challenge all US advice firms face when dealing with expat clients: are they going to stay in the United States, or will they eventually return home?

This is due to the fact that, according to what their plans may be, the type of products and financial plans put in place could change drastically, he added.

“There is no point putting in place an excellent US domestic retirement plan for a British family if they intend to return to the UK because many of the US products and investment medium will be negatively taxed on their return to the US.

“Often, international families do not know where they are going to ‘end up’ because it can be driven by children, grandchildren, cost of living or many other aspects and so the single biggest quality that needs to be applied to their planning is flexibility.”

Paul said some of the considerations to keep in mind should include whether the products and/or investments held can be adapted or changed easily should the family move to a different jurisdiction.

Subsequently, they should also consider whether the jurisdiction in question will view their holdings in a different tax perspective and assess the best course of action as a result.