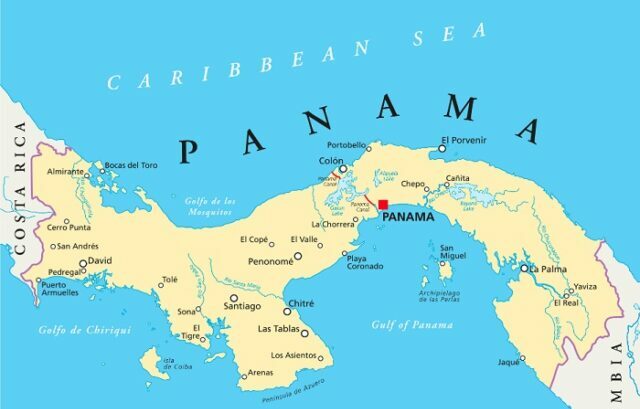

The Internal Revenue Service (IRS) has secured a court order authorising it to request records relating to US taxpayers who are suspected of using Panamanian offshore service providers to hide assets and evade taxes.

The individuals in question are believed to have used the services of Panama Offshore Legal Services (Pols) and its associates to evade federal income taxes.

The IRS is seeking to trace courier deliveries and electronic fund transfers between the Pols Group and its clients.

The aim is to identify taxpayers who have used the group’s services to create or control foreign assets and entities “to avoid compliance with their US tax obligations”, according to the Department of Justice (DOJ).

Demand for information

The IRS has been granted permission to serve what are known as ‘John Doe’ summonses on 10 entities:

- Federal Express Corporation

- FedEx Ground Package System

- DHL Express

- United Parcel Service

- Federal Reserve Bank of New York

- The Clearing House Payments Company LLC

- HSBC Bank USA

- Citibank

- Wells Fargo Bank

- Bank of America

Importantly, there is no allegation that the recipients of the summonses have engaged in any wrongdoing.

Rather, the IRS uses John Doe summonses to obtain information about possible violations by individuals whose identities are unknown.

The couriers and financial institutions have been directed to produce records that will enable the IRS to identify US taxpayers who have used Pols Group’s services.

Dubious company

This isn’t the first time that a Panamanian law firm has hit the headlines for the wrong reason.

The 2016 Panama Papers data leak from Mossack Fonseca, described at the time as the ‘biggest ever blow to the offshore world’, continues to bubble away in the background.

Pols Group likely came onto the IRS’ radar after its offshore voluntary disclosure programme identified at least one US taxpayer who had used the firm’s services to create an unreported offshore entity and account in Panama.

The company advertises services to conceal the ownership of offshore entities and accounts, the IRS stated.

These can include offering assistance with forming corporations and foundations, and creating offshore financial accounts, for the purposes of asset protection.

Pols highlights secrecy as a key advantage, promising clients “100% anonymity, privacy and confidentiality”, the US taxman added.

Other members of the Pols Group advertise that they can assist clients with concealing assets and avoiding tax.

IRS commissioner Charlet Rettig said: “These court-ordered summonses should put on notice every individual and business seeking to avoid paying their fair share of taxes u hiding assets in offshore accounts and companies.

“These records will empower the IRS and Department of Justice to find those attempting to skirt their tax obligations and ensure their compliance with US tax laws.”