UK-based wealth group Verso Wealth Management has bought Sunderland-based CDC Wealth Management for an undisclosed sum.

CDC was founded in 2006 and provides services to private clients, families, trusts and companies across the UK.

The acquisition sees Verso add £150m ($203m, €178m) in assets under advice to the group as well as expand its network and national presence with the creation of hubs in the north east of England.

As part of the deal, CDC’s four principal directors, Phil Cain, John Dixon, Andrew Mann and Sue Butterworth will remain with the firm working with Verso’s executive team to expand the group’s presence in the region.

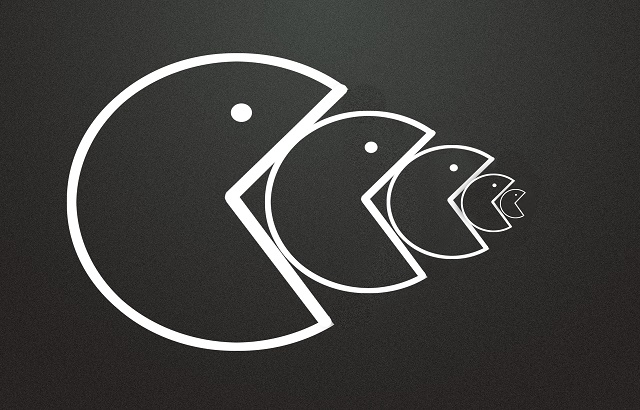

Consolidation plan

Andrew Fay, Verso chief executive, said: “I am delighted to welcome all at CDC to the group. It is an exciting time to join Verso as our plans begin to gather pace. With the support of our strategic partners, Cairngorm Capital Partners and their buy, build and transformation expertise, we are pursuing an ambitious IFA consolidation plan and accelerated growth strategy, to build a market leading, national wealth management group. CDC forms an important part of this.”

CDC’s Mann added: “We are delighted to be joining Andrew and the team at Verso. It is the natural evolution for our firm – we gain additional resources and enhanced technology, enabling us to leapfrog to the next generation of digital infrastructure painlessly.

“Pairing our expertise with Verso’s automated advice capability and straight-through-processing engine, we will be able to serve our existing clients better and importantly, broaden the types of clients we are able to serve.”