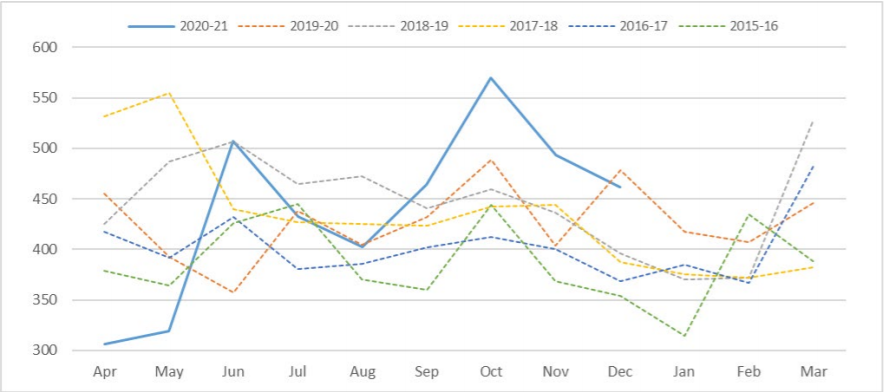

HM Revenue & Customs has released data regarding the volume of inheritance tax (IHT) receipts for the 2020-21 financial year, so far.

Payments hit two peaks, in June and October 2020, despite the year starting with a significant dip in the number of receipts.

According to the taxman, this was because it did not allow people to pay their IHT bills with cheques during the first months of the covid-19 pandemic.

“This has now been resolved, hence the peak in June,” HMRC said.

The stark increase in October was attributed to a large volume of transfers that took place during the early months of the financial year.

The main driver will be the staggering death toll from the coronavirus pandemic, plus excess deaths stemming from delayed treatments and diagnoses.

Overall, receipts between April and December 2020 are approximately £100m ($136m, €112m) higher than the same period in 2019.

With daily death tolls consistently above 1,000 since early January, receipts for financial year 2020-21 will rise further.

‘Not immune’ to covid effect

Neil Jones, tax and wealth specialist at Canada Life, said: “Today’s results show that covid-19 is continuing to have an impact on how HMRC is able to collect and receive across several taxes, and it looks like IHT has not been immune to this.

“Results for the 2019/2020 tax year already show the beginning of a slight dip in IHT receipts which, for the large part, has been attributed by HMRC to their refusal to accept cheques in the early stages of the pandemic.

“A situation which has now been resolved. Interestingly, HMRC has also provided a glimpse into the IHT receipts received so far in the current tax year, finding that they are already up by £100m on the same period the year before.

“If this trend continues, we can expect IHT and other income and capital related taxes to start playing an increasingly important role, especially as we start to see falls in consumption taxes such as alcohol and fuel.”

Source: HMRC