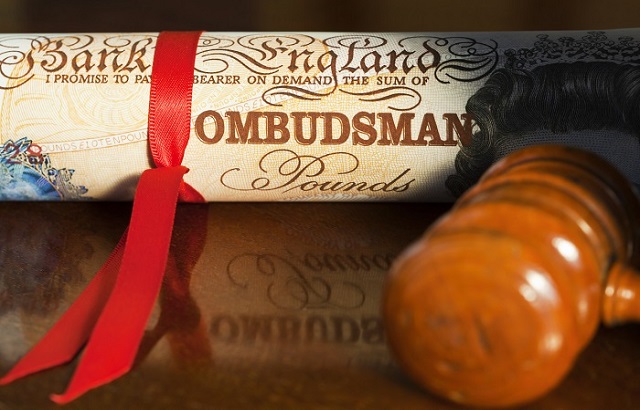

The UK’s Financial Ombudsman Service (FOS) will be able to force firms to pay out higher compensations to consumers and businesses from 1 April 2019, after the measure was confirmed by Financial Conduct Authority (FCA).

The amount of money that the FOS can require from firms will increase to £350,000 ($456,8000, €406,643), from the current £150,000.

However, complaints preceding 1 April will see the limit rise to £160,000.

Additionally, the change will come into force at the same time as the extension of the service to larger small and medium-sized enterprises, the FCA said.

Those are defined as firms with an annual turnover of under £6.5m, an annual balance sheet total under £5m, or fewer than 50 employees.

As a result of the extension, 210,000 additional firms will be able to complain to the FOS.

“Consumers and small businesses struggle with the cost and time needed to take firms to court, so it is essential they can receive fair compensation from the Financial Ombudsman Service when things go wrong,” Andrew Bailey, chief executive of the FCA, said.

Problems for DB transfers

Increasing the amount for compensation can be “good news”, but not when it benefits a small number of people and impacts DB transfer advice, Steve Cameron, pensions director at Aegon, said.

“This is because the FCA’s decision is likely to have major implications for the cost of advice. Financial advice is a requirement for anyone with a DB pension worth more than £30,000 so it’s essential people have access to advice, particularly as transferring won’t be the right thing to do for most people.

“The FCA suggests the changes could mean firms currently offering advice on DB transfers could face a 140% increase in already very expensive professional indemnity cover. This will inevitably lead to increased costs passed to customers.

“But even more worrying, the FCA predicts 1,000 of the 2,500 firms currently offering such advice will stop doing so. Neither of these developments are good news for customers needing professional advice,” Cameron added.