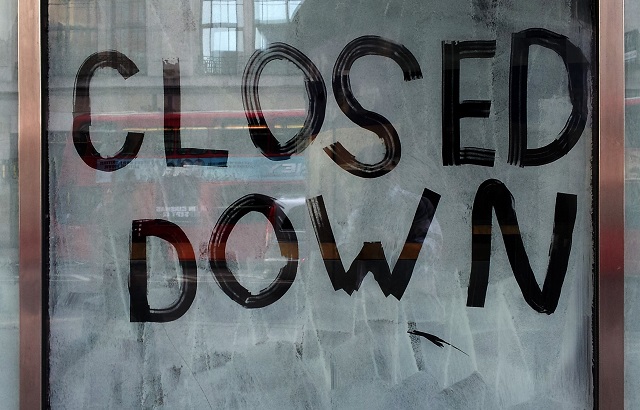

Glasgow-based Cowley & Miller Independent Financial Services has failed, the Financial Services Compensation Scheme (FSCS) announced.

As a result, the lifeboat scheme said clients “may be able to make a claim against it”.

A spokesperson for the FSCS confirmed to International Adviser that 34 claims have been made against Cowley & Miller so far, all of which relate to unsuitable pension transfer advice.

Since 2017, the Scottish IFA received 11 complaints filed with the Financial Ombudsman Service (FOS), 10 of which were upheld by the FOS, and they were all related to pension advice.

On 2 March 2022, the company filed an extraordinary resolution to wind up, according to documents on Companies House.

The firm said that, during its general meeting, “it has been proved to the satisfaction that the company cannot by reason of its liabilities continue its business and that it is advisable to wind up same and accordingly that the company be wound up voluntarily”.

As a result, Margo McLean, insolvency practitioner at McLean Corporate, was appointed as liquidator.

Details

According to information on the Financial Conduct Authority (FCA) register, Cowley & Miller was subject to a pension transfers pre-sale review in 2018, and was handed an asset restriction order in June 2021.

The register also shows that the IFA firm used to have two appointed representatives, namely Tidal Wealth Management – from August 2013 until May 2016 – and Clifton Gillis – from January to June 2014.