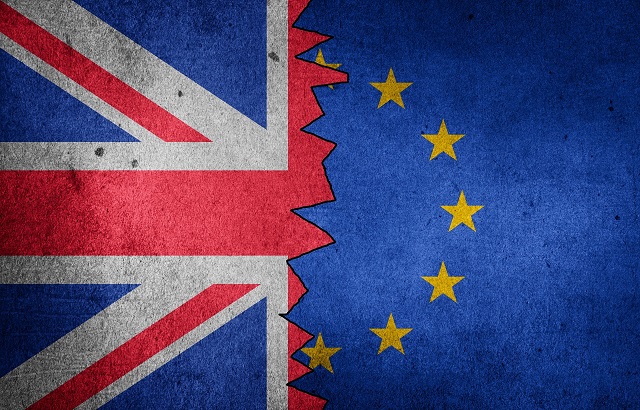

British prime minister Boris Johnson and president of the European Commission Jean-Claude Junker have reached an agreement on how the UK will leave the EU.

The biggest concerns to date regarded the Ireland/Northern Ireland border and the political declaration outlining the future relationship between the two, for both of which a middle ground has been found, Junker said in a letter to the president of the European Council, Donald Tusk.

While the financial services industry welcomed the milestone event, it remains sceptical.

Don’t get too excited

Adrian Lowcock, head of personal investing at Willis Owen, said: “Boris Johnson’s announcement of a great new deal has gotten currency markets excited but investors should be wary, we have been here before and it didn’t end well.

“There is still a lot of work to be done. However, what is clear from the initial reaction is that the Brexit issue has been weighing on the UK currency and indeed stock market.

“Events over the weekend will be the deciding factor.”

He added: “Whilst investors shouldn’t get too excited if a deal is done, there is the potential for markets to rally quickly on the news.

“The UK market has looked cheap for a while and there are some attractive opportunities. However, because there are still many risks, the best course of action is to be diversified as this will give you the flexibility needed to navigate a complex situation.”

Parliament’s hold

Ewout Van Schaick, head of multi asset at NN Investment Partners, said: “We are closely watching the ongoing developments in the Brexit process.

“The announcement of a deal between the UK and EU is a positive indication of reduced uncertainty and decreases the risk of a disruptive no-deal Brexit.

“However, the deal still requires parliamentary approval, which is by no means certain.”

Lots of challenges ahead

Marija Veitmane, senior strategist, multi-asset at State Street Global Markets, said: “The ‘agreed deal’ is just a step in Brexit resolution.

“We still see a lot of challenges ahead. The economic rationale for both sides to reach the deal has been present for a long-time, but unfortunately politics has been standing in the way.

“Those issues are yet to be resolved.

“From a financial market point of view, the resolution of Brexit impasse would be extremely positive as it removes a large headwind for both UK and European economies.

“However, the immediate reaction to the news suggest that the market needs confirmation that the agreed deal can go through the Parliament before rallying strongly.”

Not supportive

The future of the newly-agreed Brexit deal is still uncertain considering that Northern Ireland’s Democratic Unionist Party (DUP) said it will not support it, and the Liberal Democrats claiming they will not consider it unless Johnson calls for a confirmatory second referendum.

Labour party leader Jeremy Corbyn claimed the prime minister’s deal to be “worse than Theresa May’s” [the former prime minister] and that “it should be rejected”.