The Australian financial planning and advice industry is expected to undergo a complete reshaping after new laws and education requirements came into effect at the beginning of 2019.

While previous requirements from the Australian Securities and Investment Commission (ASIC) allowed financial advisers to become qualified after a four-day training course; now professionals are required to hold a ‘tertiary-level degree’ to qualify.

Experts deemed this move a way to “professionalise the sector”, although 6,000 entry-level advisers and over 6,000 financial planners could lose their qualifications and not be able to work in the industry, unless they acquire the certifications needed under the new education criteria, according to research by the Financial Planning Association of Australia.

The move came after a consultation launched by ASIC in November 2018.

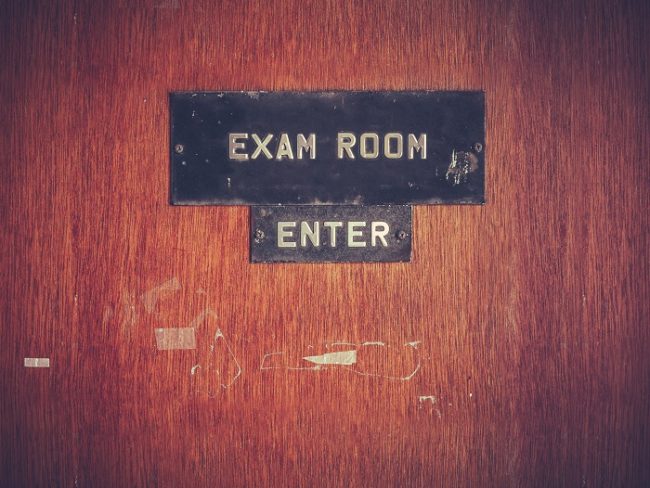

Under the new rules, and in addition to the education requirement, all financial advisers are required to sit a three-and-a-half-hour exam and adhere to a new code of ethics as of 1 January 2019.

Advisers will have until 2021 to sit their exam and until 2024 to gain the tertiary-level degree; although some experts said ASIC could have allowed advisers more time to prepare for the new criteria.

Also from 1 January, people with several years’ worth experience and/or degrees may see their qualification taken away if their certifications don’t comply with the new rules.