‘Extremely difficult’ DIY platforms ‘refuse to deal’ with advisers

As do-it-yourself investment accounts hit all time high of 9.54 million

As do-it-yourself investment accounts hit all time high of 9.54 million

Our rugby players have chosen to stay put and not go back home – do their financial plans need a complete overhaul?

Our players have been offered further three-year deals – how will that impact their financial plans?

What financial planning does it take to up sticks and move a family to the other side of the world to pursue a professional sporting career?

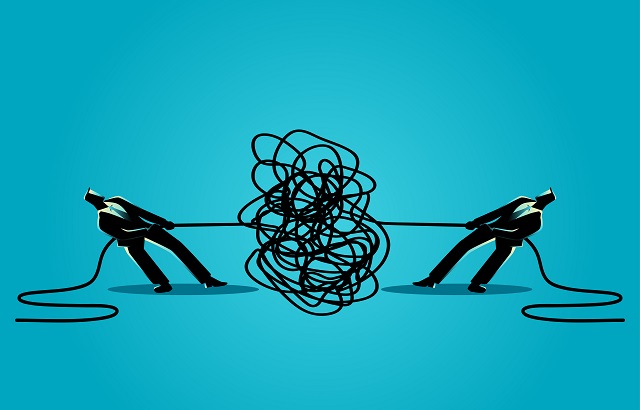

Tug of war means clients can struggle to move their retirement pots

One advice firm saw its 2020 cover rise by 400% despite no claims or DB transfers

As economic secretary to the Treasury passes the buck to the regulators for action

Spate of hires due to fact that ‘there is simply not enough advisers to provide advice in the UK’

UK pension transfer specialist O&M Pension Advice will cease advising clients from 1 July after it ran into “unexpected difficulties” with its professional indemnity (PI) insurer, a problem that is becoming more common in the advice market.

If an adviser’s ultimate aim is to run a practice where clients will cheerfully pay the fees, the first step must be to counter some false truths about value, says Phil Billingham.

The tricky area of client segmentation and why financial advisers need to do it is the focus for well-known industry figure Phil Billingham, in his second article looking at how firms can survive amid regulatory change.

A hurricane of difficult regulation is to going hit the European financial advice industry, and for some companies and countries it is already too late, the audience of IFAs at International Adviser’s Future Advisory Forum Europe heard on Thursday.