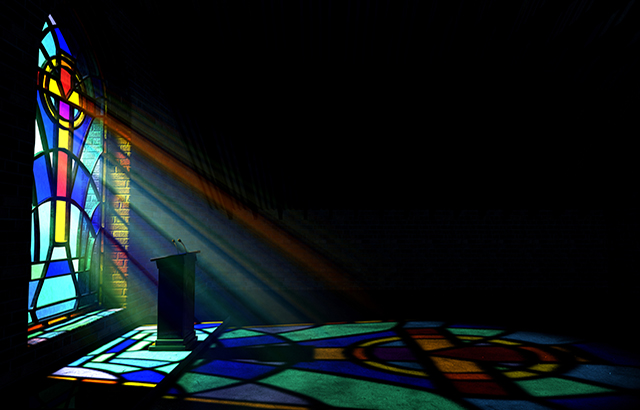

UK investment firm unveils Christian ethics MPS range

It is the company’s first managed portfolio service

It is the company’s first managed portfolio service

Firm will offer impact investment-focused products looking to tackle climate change and social inequality

46% of UK wealth managers plan on using model portfolios more extensively over the next two years

Deal adds £800m in assets under management

It plans to cut acquired firm’s fees to 0.15%

As it prepares to bolster MPS range with responsible and sustainable portfolios

It will have a DFM charge of 0.25%

As the companies sign a three-year distribution deal

Products will be on mainstream platforms

To protect investors from sequencing and shortfall risks in retirement

Annual management charge will be 0.2% with OCF capped at 0.75%

Shortly after rival Schroders unveiled its own low-cost range