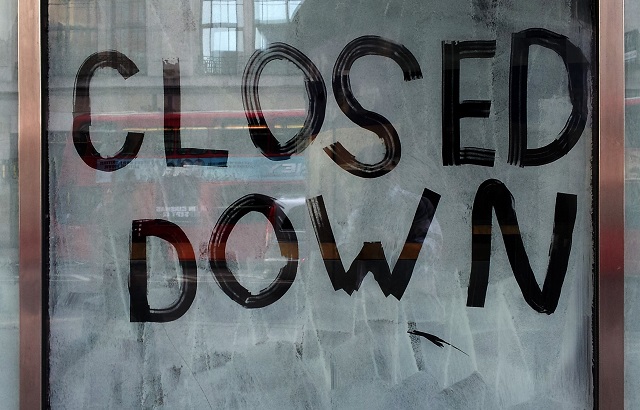

4,000 UK firms at risk of failure due to covid

As FCA warns around 30% have ‘potential to cause harm’ if they closed down

As FCA warns around 30% have ‘potential to cause harm’ if they closed down

While administrators force company’s marketing unit into insolvency to recoup losses

It became insolvent based on the potential claims over high-risk investments

It comes after a group of LCF investors launched a crowdfund campaign to challenge the FSCS

It will support individuals facing existing or anticipated financial difficulties

Clients were left with no money after it made high-risk unregulated investments

The Financial Conduct Authority (FCA) has declared discretionary fund management firm Beaufort Securities and its clearing arm, Beaufort Asset Clearing Services, insolvent.

Creditors of stricken overseas investment scheme Harlequin Property SVG have been invited to a meeting on 31 March 2017 to vote on the appointment of a bankruptcy trustee and investigators.

Harlequin Property SVG, the company behind the £400m ($509m, €454m) overseas property scheme, has officially entered insolvency proceedings, a decision likely to result in hefty losses for thousands of investors.

The United Arab Emirates (UAE) is to get a new bankruptcy law for businesses, including a new regulatory body for financial restructuring, which is designed in part to remove the threat of jail for executives of companies facing financial distress.

European Pensions Management (EPM), a UK-based self-invested personal pension (Sipp) provider with over 6,000 customers, has formally entered insolvency proceedings under the special administration regime.

Crowdfunded claims management company Rebus, which specialised in pursuing companies for mis-selling investments later deemed to be tax-avoidance schemes, has entered administration.