Expats feel most at home in Bahrain

Bahrain topped HSBC’s Expat Explorer survey with two thirds of expats feeling at home within a year of moving.

Bahrain topped HSBC’s Expat Explorer survey with two thirds of expats feeling at home within a year of moving.

The firm believes “lower for longer” will apply to energy prices, inflation and interest rates over the next five years.

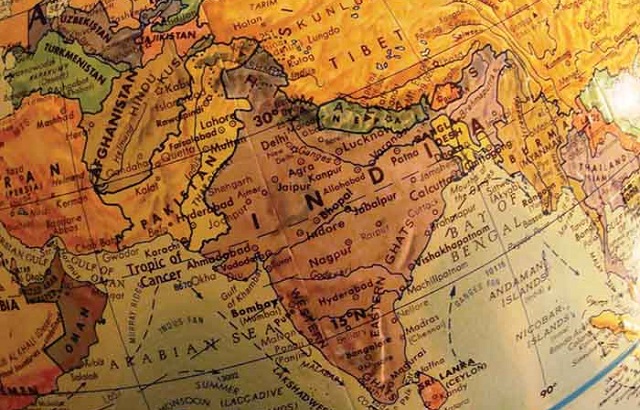

Ashburton Investments is set to launch a new Sterling share class for its US dollar-based India Equity Opportunities Fund.

Portfolio managers of Asia ex-Japan equity funds favour India while avoiding Malaysia and Australia, according to Morningstar.

Georgina Hellyer, portfolio manager at Columbia Threadneedle Investments, outlines the three hottest EM areas investors should be looking at right now.

UK online investment platform Rplan saw a 280% year-on-year increase in flows into Indian-only funds in 2015, as investors looked to capitalise on the stock market’s strong performance over the past year.

Fund Selector Asia compares the First State Indian Subcontinent Fund with the Matthews Asia India Fund.

Are Indian equities expected to outperform in 2016 compared to 2015?

For funds invested in Indian equities, 2015 is shaping out to be a good year as the country shows that it is able to reward investors with its resilient domestic consumer base.

State-owned Indian companies, which produce materials for road and highway construction, will likely issue more rupee bonds to fund infrastructure projects, said Ajay Marwaha, Sun Global Investment’s director of investments.

Treating the BRIC nations as a single investment bloc “was a triumph of marketing over economic analysis,” said Kevin Gardiner, Rothschild WM’s global investment strategist.

Samir Mehta, manager of JO Hambro’s Asia ex-Japan Fund, gives his observations from a recent research trip to India, a market which is a large overweight in his portfolio.