Rich Americans more willing to invest

Market performance keeps them positive but politics and national debt cast shadows

Market performance keeps them positive but politics and national debt cast shadows

Wealth managers urged to rise to the occasion or lose clients to foreign providers

Focus on emerging risks, proactive measures to prevent disasters and the art of exceptional customer service

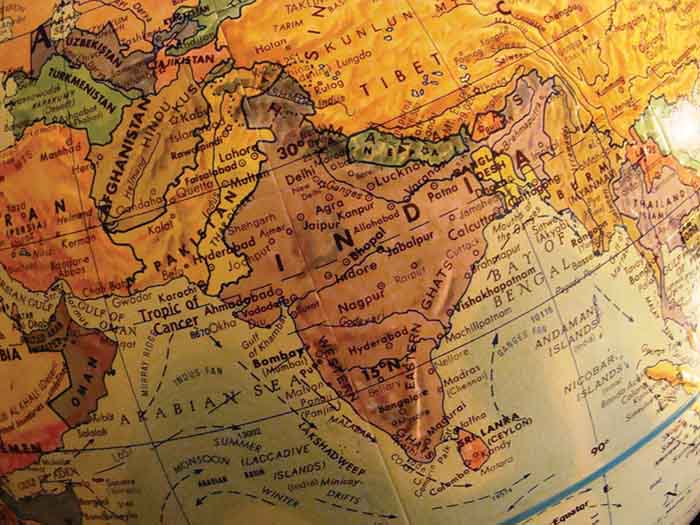

Asian duo India and Sri Lanka made up the top five with an increase of 98% and 96%, respectively

It hopes the two funds will meet ‘the unique investing needs of its wealth management clients’

Experts disagree on what is stopping women from breaking the wealth barrier

WealthX’s high net worth handbook reveals some big changes within the wealth sector last year Click through the slides below to find out more

Capgemini report found the country had the fastest growth of wealthy individuals in 2016-2017

High net worth investors want less complex fee structures and more personal connection

Rich individuals looking to move to the UK are to be offered the chance to take part in a “revolutionary” streamlined immigration process.

The British Virgin Islands is now home to the Bank of Asia, a fully digital, cross-border bank looking to address the growing needs of offshore companies, individuals and high net worth individuals.

Wealth managers should go beyond a pure functional role and work more on the personal connection with high net worth clients, according to David Wilson, head of Asia wealth management at the consulting firm Capgemini.