Will taper tantrum happen again?

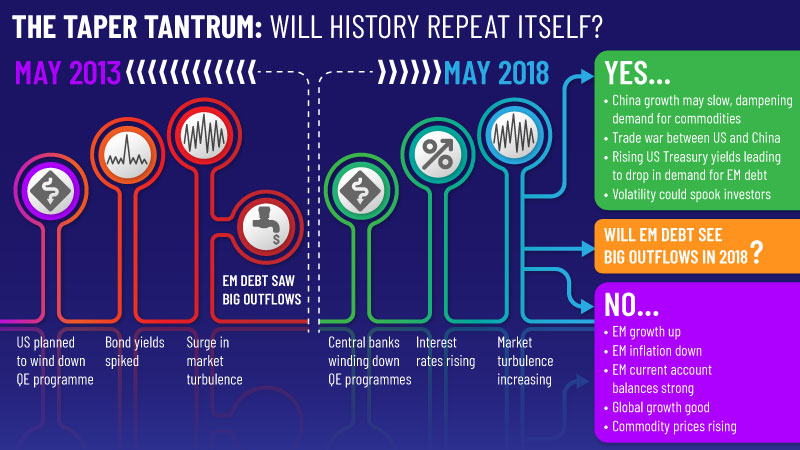

Emerging market debt has been attracting robust inflows but as monetary policy tightens and volatility rises can the asset class retain its appeal?

Emerging market debt has been attracting robust inflows but as monetary policy tightens and volatility rises can the asset class retain its appeal?

Stephenson Harwood appoints a new partner in Hong Kong, Julius Baer sees a senior exit in the Middle East and raids Barclays Wealth for UK expansion, Intertrust appoints Netherlands head and Brewin Dolphin appoints Axa’s Kellard as a non-exec director.

US president Donald Trump may be touting his pick for Federal Reserve chair as an “anxiously awaited” event, but how are investors preparing for Thursday’s big reveal?

Emerging market debt has been the best-selling asset class with European investors this year, but flows turned negative in late September against a backdrop of a hawkish Fed and a strengthening dollar.

The US Federal Reserve announced it will begin to unwind its quantitative easing programme in October, and said another rate hike this year is likely despite persistently low inflation.

The damage caused by hurricane Harvey will dampen US GDP growth to an extent that will force the Fed to forget about hiking rates further this year, it has been claimed.

The US equity market hit new highs, but bond yields are expected to fall after the US Federal Reserve voted to keep rates on hold at its latest meeting.

Highly-leveraged US companies face a disproportionate rise in interest payments as the Fed has started hiking. But investors aren’t being compensated for this at all.

The US airstrike on Syria and disappointing jobs data immediately brought down markets last week, and investment managers are beginning to protect their portfolios against more of the same.

The third 0.25% interest rate hike of this upcycle from the US Federal Reserve begs five questions, all of which have implications for the US, the globe and portfolios.

There is a long line of asset managers rolling out funds aimed to “balance” and “diversify” returns, but is the multi-asset universe about to be turned on its head?

The dollar surged this morning on the back of only the second Fed rate rise since the 2008 financial crisis.