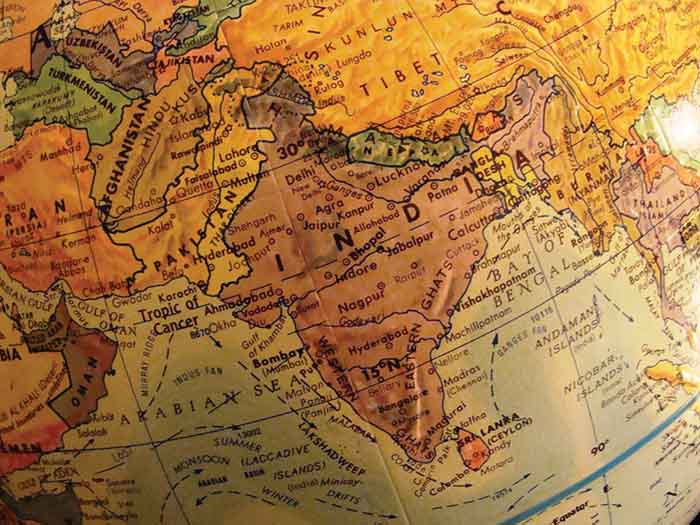

Rupee rout is double edged for non-resident Indians

As the rupee finds a new level and India’s economy faces a bad patch, opportunities abound for NRIs

As the rupee finds a new level and India’s economy faces a bad patch, opportunities abound for NRIs

The prospect of a US government shutdown has seen the pound climb to its highest level against the dollar since Brexit, while cryptocurrency Bitcoin continues to decline.

Sterling has had a mixed reaction to Britain and the EU completing the first phase of negotiations and reaching a historic deal overnight.

Following the recent news of progress on the Brexit “divorce bill”, sterling hit a two-month high this week, and was up against both dollar and euro. Despite the uptick, the main question still remains, will sterling continue to strengthen or is it in danger of collapsing in the face of political turbulence?

UK advisers with clients looking to move to Portugal and make the most of tax-efficient opportunities but avoid costly mistakes need to consider seven key questions, according to international wealth and tax management firm Blevins Franks.

ETF provider First Trust Global Portfolios (FTGP) has launched what it describes as the first actively managed ETF in Europe focused on investing in global foreign exchange markets.

Sterling fell on Tuesday morning in reaction to Mark Carney’s claim that “now is not yet the time” to hike interest rates in the UK.

The universally acknowledged poor decision by UK prime minister Theresa May to call a snap election and then alienate her core voting base, resulting in a hung parliament, initially dented sterling by around 2% but has had little real impact on the stock market.

This year’s dollar weakness took most investors by surprise. There are, however, obvious reasons for this, and fundamentals suggest it could reverse.

The British currency has suffered its biggest fall since April after a poll suggested the Conservative party’s lead in the UK general election had diminished.

Schroders has launched a multi-asset fund for Johanna Kyrklund designed to weather potential storms in equity and bond markets.

Sterling hit an eight-week low on Tuesday morning in reaction to parliament’s approval of the Article 50 bill – but with at least two years of negotiations ahead, could the currency fall even further?