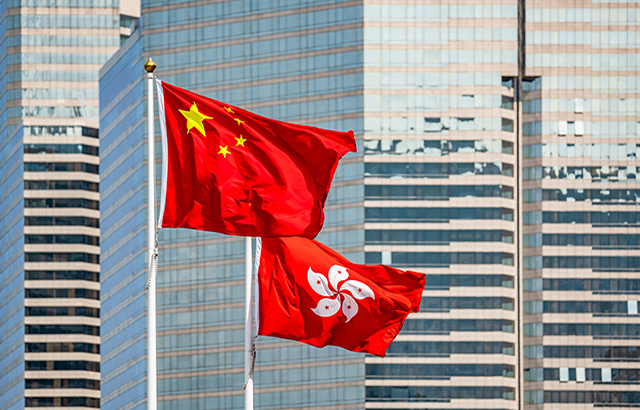

Personal wealth leaving China sees AIA’s business grow 60%

One of Asia’s largest insurer AIA has reported a whopping 60% growth in the value of new business from mainland China as regulators struggle to stem the flow of personal wealth leaving the country via Hong Kong’s offshore insurance industry.