EM equities see rapid rise in retail flows

Retail investment platform Rplan saw a big increase in flows into emerging market funds over the last three months, with the notable exception of China-only investments.

Retail investment platform Rplan saw a big increase in flows into emerging market funds over the last three months, with the notable exception of China-only investments.

In the first half of the year, 60% of Asia’s outbound property investment was from mainland China, according to CBRE Asia-Pacific.

The Shanghai-based wealth manager Noah Holdings has set up a trust with international service provider JTC in Jersey to address the increasing succession planning needs of its high net worth clients in China.

One year on from China’s surprise currency devaluation, there is still room for a further gradual depreciation of the renminbi against the US dollar, said Jade Fu, investment manager at Heartwood Investment Management.

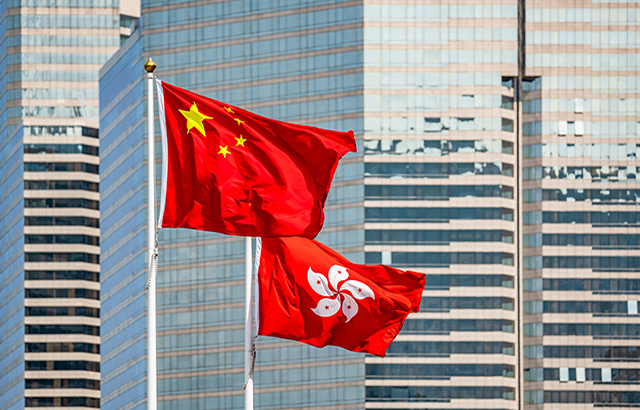

China’s regulators have formally approved the Shenzhen-Hong Kong Stock Connect, which was expected to launch last year.

One year after the surprise yuan devaluation and subsequent market crash, $4.5bn has flowed out of funds focused on China equities, according to data from Morningstar.

The number of would-be investment managers in China entering the Chartered Financial Analyst (CFA) programme reached a record high in 2016, overtaking new registrations from the US for the first time, latest figures from the CFA institute show.

Standard Life has reported a small rise in assets held in offshore bonds on its wrap platform as part of its strong set of half year results for 2016, which also included details of the company’s expansion into India’s private pension market.

As the world’s attention turns to Rio for the opening of the 2016 Olympic Games on Friday, fund managers have assessed the investment opportunities on offer in the most powerful Olympic sporting nations.

Brexit has not had an impact on China’s markets, and valuations are historically cheap, according HSBC Global Asset Management.

With global growth slowing and developed-market government bonds at a record low, fixed income managers are focusing on opportunities in spread sectors.

French insurer Axa has entered into a worldwide strategic partnership to distribute its insurance products and services through the global ecommerce ecosystem of China’s Alibaba.