Number of HNWIs globally drops by 3.3%

Value of their wealth has also decreased by 3.6%

Value of their wealth has also decreased by 3.6%

‘There is no one-fits-all solution to educating millennials’

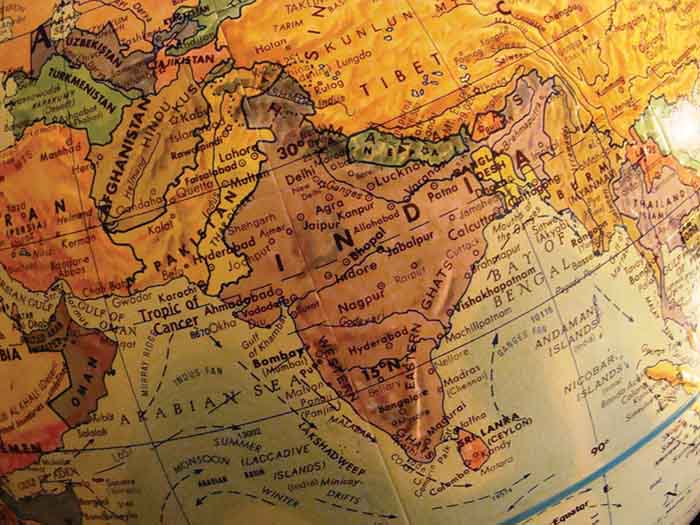

Capgemini report found the country had the fastest growth of wealthy individuals in 2016-2017

High net worth investors want less complex fee structures and more personal connection

The global wealth of high net worth individuals rose by 7.5% in 2016, presenting an opportunity for wealth managers and technology firms, according to the Capgemini World Wealth Report 2017.

Wealth management firms in Asia are ramping up domestic recruitment due to rising demand by Asian clients for advice from managers with local knowledge, language skills and cultural understanding.

Recent moves in the US suggest that the country is bringing in its own version of the retail distribution review “through the backdoor”, according to Capgemini Consulting’s Rod Bryson.

Advisers are losing business because they are failing to provide clients with a good customer experience, not because other companies are beating them on price, according to Rod Bryson, principal – wealth, long-term savings and insurance at Capgemini Consulting.

More than half of the financial advisers across international markets are transforming their business model away from upfront remuneration towards more recurring revenue streams, according to new research from Old Mutual International.

The Asia-Pacific was the fastest growing region in 2014 for high-net-worth individuals, those with $1m investable assets.

High net worth individuals are generally pretty happy with their wealth managers at the moment.

Asia-Pacific is set to become the region with the largest number of high net worth individuals (HNWIs) and highest wealth growth by the end of 2015, after recording world leading growth in 2013.