The number of large funds containing assets over £1bn that are underperforming has taken a “worrying” turn for the worse over the past six months, according to Bestinvest’s latest Spot the Dog report.

The bi-annual study compiles a list of all funds that have underperformed their benchmark by 5% or more over the past three years.

There are 137 funds on the list currently, which remains unchanged since the last report in August 2024, though the assets held in these portfolios leapt from £53.4bn to £67.4bn by the end of the year as larger vehicles entered the list.

Most funds on the list are relatively small at an average size of £167m, yet 15 mega funds with assets exceeding £1bn account for 59.6% of the list’s total holdings at a combined size of £40.1bn.

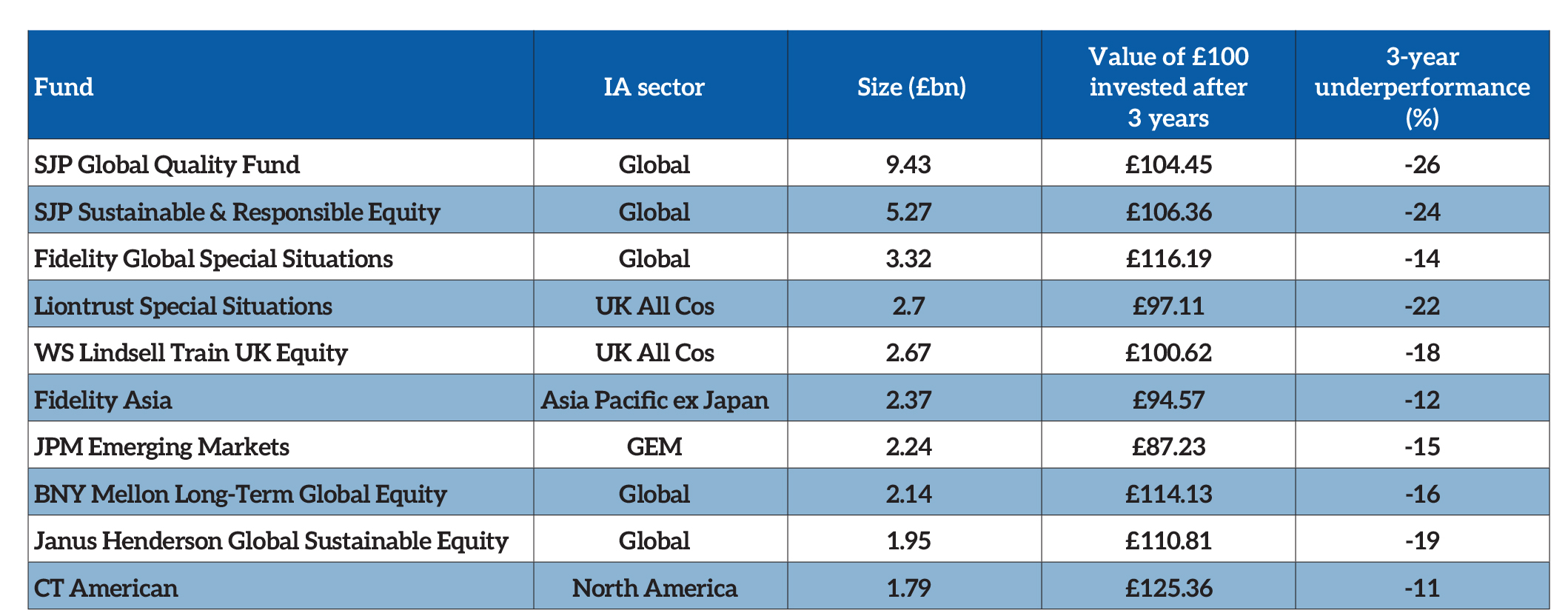

Ten largest underperforming funds

There were just 10 mega funds in the list last August, which were jointly worth £26.8bn. Jason Hollands, managing director of Bestinvest, said: “This eye-watering sum is a big step up from the last report.”

The largest of these giants was also the worst underperformer. The SJP Global Quality fund generated a mild return of 4.5% over the past three years to the end of 2024 versus a 30.1% gain from the MSCI World index.

Another of St James’s Place’s giants – the SJP Sustainable & Responsible Equity fund – was the second worst underperformer with a total return of 6.4%.

These two funds alone contain £14.7bn in assets under management according to Bestinvest, yet their factsheets claim to have £21.2bn.

Other asset managers to have multiple dog funds on the list – seven each – include Fidelity, Columbia Threadneedle and Liontrust.

Liontrust was the only of these firms to have a fund added since the last report, with Columbia Threadneedle losing two and Fidelity one.

Hollands said: “The biggest eyebrow raiser is the inclusion of the Liontrust Special Situations fund, once seen as its flagship fund. It holds significant exposure to smaller companies, which have struggled in recent years.”

The £2.7bn fund managed by Anthony Cross and Liontrust’s Economic Advantage team is down 2.9% over the past three years, falling behind the MSCI United Kingdom All Cap index’s 18.9% return.

The IA UK Smaller Companies sector had the highest proportion of underperforming funds as a percentage of its overall size, with the 11 dog funds representing 28% of the sector. It was brighter news for the IA UK All Companies sector though, with the number of dog funds falling from 44 to 30 since the last report.

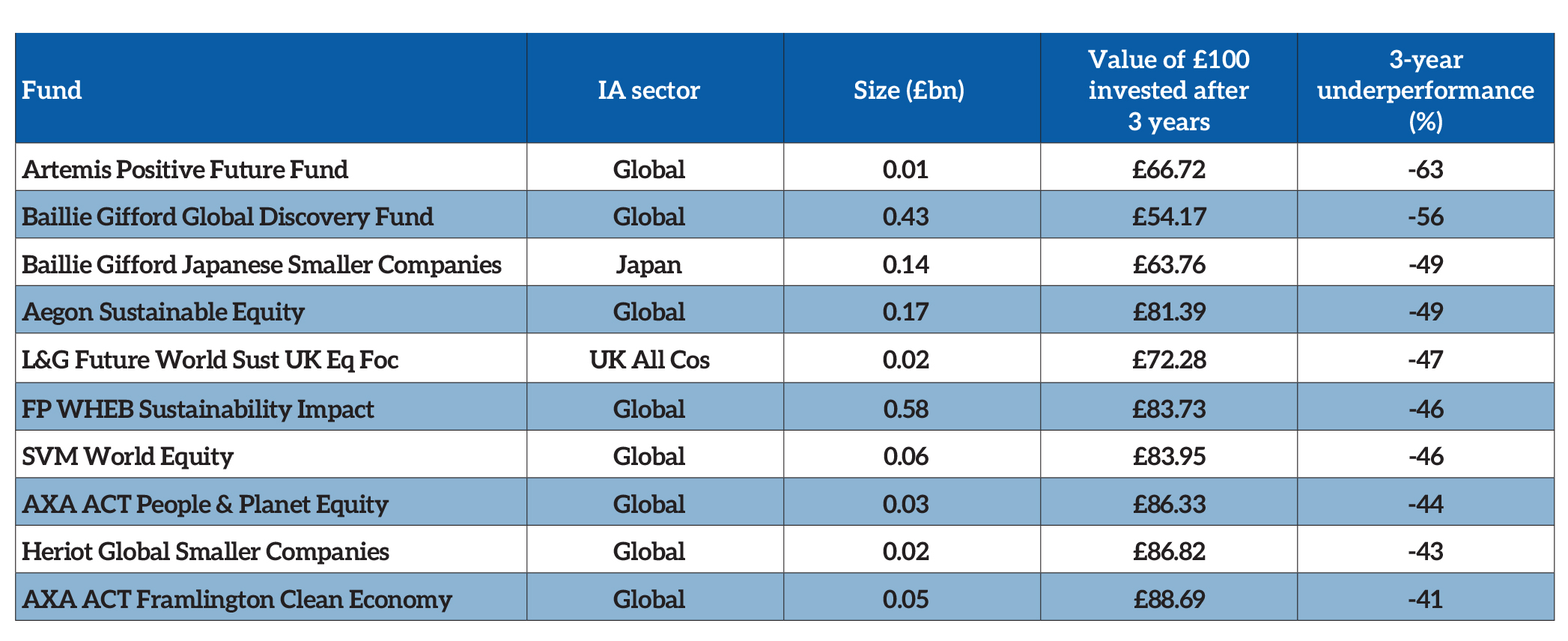

Underperformance of ESG funds continues to worsen

One overwhelming trend that Hollands highlighted was the ongoing underperformance of sustainable funds, which has continued to worsen in past Spot the Dog reports.

“The markets of recent years have not favoured such funds, with a huge surge in oil and gas stocks in 2022 on the back of Russia’s invasion of Ukraine, and negative returns from alternative energy shares in both 2023 and 2024,” he said.

Artemis Positive Future was the worst performing fund overall, dropping 32.5% over the past three years versus a 30.1% gain from the MSCI World index.

Ten worst performing funds

Other funds with environmental, social and governance (ESG) strategies such as L&G Future World Sustainable UK Equity Focus, Aegon Sustainable Equity and FP WHEB Sustainability Impact were among the worst performers, with each falling 27.7%, 18.6% and 16.3% respectively over the past three years.

Many of these funds are within the IA Global sector, which had the highest number of underperformers with 44 funds dog portfolios – the combined value of which rose 34% to £35.2bn since the last report.

Yet Hollands noted that just because a fund appears on the list, it isn’t necessarily a call to sell.

“This is not a sell list,” he said. “However, funds that appear in it may require further investigation. Unless there are good reasons to believe performance will turn around based on an assessment of its prospects, it may make sense to switch to an alternative fund.”

This story was written by our sister title, Portfolio Adviser