Professor Marco Di Maggio of Harvard Business School published a research paper in May called What Drives Growth for Financial Advisers? Evidence From a Multi-Year Survey.

Based on data from five years of Dimensional Fund Advisors’ annual Global Adviser Study, the research provides insight into the characteristics of some of the most successful advice firms in the world.

In this interview, Professor Di Maggio explains what advisers can learn from his research into Dimensional’s data.

1. Why did you decide to research what drives growth for financial advisers?

Financial advisory firms play a central role in shaping individuals’ investment decisions and financial well-being, and the industry has been growing at a staggering pace. However, the existing research has focused on the impact of financial advice on investors’ behaviour, and very little is known about the types of services and practices that help these firms grow. The survey data collected by Dimensional allows us to fill this gap by analysing the inner workings of financial advisery firms.

2. What data was available to you?

In this paper, we focus on advisory firms in the US, with the majority being independent, fee-only advisers. We study survey years 2015 to 2019, because the unique Covid-19 situation may impact the data in 2020. On average, we have about 900 firms each year that collectively serve 191,000 clients and manage about $250bn. The sample provides a broad representation of advisery firms across US states, clienteles, asset size, and age. And even though we focus on the US, it’s fair to assume the findings can be used to gain insight into other markets.

3. Advisory firms assess their performance in many ways. Some care more about revenue growth or revenue per advisor, and others may pay more attention to client or employee retention. Your focus is growth. What are your main findings?

Correct. We examine how the growth in assets under management (AuM), revenue, or number of clients is related to advisers’ service offerings, client sources, and practice management challenges.

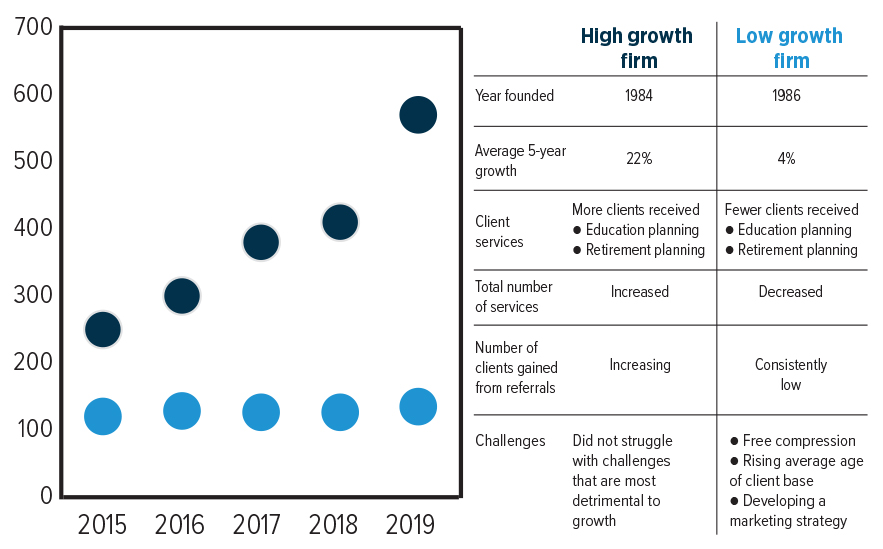

Let me illustrate our key findings with two real firms that participated in the survey. Over our sample period, 2015 to 2019, one firm (let’s call it the high-growth firm) more than doubled its initial AUM of $250m (£207m, €238.5m) and achieved an average annual growth rate of 22%. In contrast, another firm (let’s call it the low-growth firm) saw its AUM stay relatively flat, growing at 4% per year. So, what did the high-growth firm do differently?

Well, let’s start with service offerings. The high-growth firm had more clients receiving education planning and retirement planning services than the low-growth firm. The high-growth firm also increased the number of services, whereas the low-growth firm offered fewer services over time.

This is representative of what we find in the paper. Firms offering a larger variety of services tend to grow more. Specifically, a 10-percentage-point increase in clients receiving education planning, retirement planning, insurance services, or account aggregation is associated with about a half percentage point of additional growth in AUM, revenue, and clients in the same year.

In addition, investment solutions play an important role. The use of model portfolios, a greater number of model portfolios, and the use of small-account solutions are associated with stronger growth.

EXHIBIT 1

A Tale of Two Firms

Illustrative example: AUM for high- and low-growth firms ($m)

Source: Dimensional’s Global Advisor Study

The depth vs breadth of service offerings is often an important trade off advisors need to make when structuring their practices, and the results confirm the importance of having a broader portfolio of services and investment solutions when growing an advisery firm. Intuitively, that breadth provides advisers with the opportunity to serve a broader set of clients with diverse needs. Furthermore, areas such as retirement planning create deeper, longer-term engagement with clients.

4. The two firms in your example differ in their number of clients gained from referrals. Can you elaborate on that?

That’s right. The low-growth firm gained few clients from referrals. In contrast, referrals served as an increasingly important client source for the high-growth firm.

Again, this is consistent with the results in our paper. The most important channels for sourcing clients are referrals from existing clients and referrals from centres of influence, or COIs (such as CPAs, attorneys, and insurance agents). We find that gaining 10 more clients from client referrals is associated with an increase of 1–2 percentage points in AUM, revenue, and client growth in the same year and an increase of 0.5–1 percentage point in later years.

Interestingly, referrals from COIs appear to have twice as large an effect on growth as referrals from existing clients. COIs’ greater impact might be due to their industry-specific knowledge as well as their experience working with multiple advisers. Lastly, we find firms that gain new clients from multiple sources and meet with more prospects also grow more.

5. What challenges negatively impact growth?

Going back to our example, the low-growth firm struggled with fee compression, the rising average age of their client base, and developing a marketing strategy—none of which were top challenges for the high-growth firm. Indeed, our analysis shows that practice management challenges like these are associated with weaker growth.

In particular, among all the challenges studied, the rising average age of the client base and a lack of a succession plan or exit strategy appear to be the most detrimental. Compared with advisors who do not struggle with these challenges, those who do struggle exhibit 5–9 percentage points lower AUM, revenue, and client growth over the same time periods.

Fee compression is interesting because, while it might be a top challenge for some firms, we’ve not seen overall fees decline in Dimensional’s study. In fact, between 2018 and last year, we actually see fees increased slightly. That said, we do observe some profitability compression as firms offer more services and the costs of doing business increase.

DATA APPENDIX

The data used in the What Drives Growth for Financial Advisers? Evidence from a Multi-Year Survey analysis are generated from an annual survey of financial advisors administered by Dimensional Fund Advisers. For more details about the data and methodology, please see the paper.

This article was written for International Adviser by Dimensional Fund Advisers and Professor Marco di Maggio who provides consulting services for Dimensional Fund Advisers LP.