The financial advice M&A merry-go-round shows no sign of stopping with another IFA firm popping up to ride the carousel.

Independent Wealth Planners (IWP) was set up in 2018 and opened its doors in November 2019, saying at the time it was in talks with 20 advice businesses and had a pipeline of more than 100.

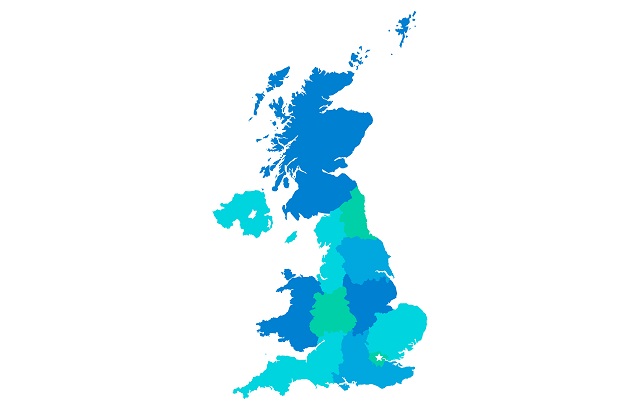

The firm is set to become one of the most active acquirers in the sector and told International Adviser it has ambitions to have around 50 offices across the UK by 2021.

Hub model

David Inglesfield, chief executive at IWP, said: “If you look at the map of the UK and where the population lives, something like 50 offices would mean most people would be within an hour’s drive of an office.

“We use a hub model; we acquire a number of businesses and merge other businesses into them.

“We think we will get to somewhere between a dozen and 20 of those larger businesses in main cities or in key locations.

“Then they might each have a couple or three satellite offices.

“We are having a few other conversations in Scotland at the moment and we’re also having some conversations in Northern Ireland. It’s a UK-wide strategy.”

Double your money

IWP has already been very active and recently completed its seventh deal since it opened four months ago.

The firm said that there is “no set target” for assets or deals.

“We’re currently at £2bn ($2.58bn, €2.39bn) of client assets or will be, by the end of the first quarter,” said Inglesfield.

“I would imagine it will probably be double that by the end of the year.

“We are getting a lot of interest at the moment. That’s probably another 10 or 20 deals, depending on the size, maybe more.”

Shopping list

Consolidators in the financial advice space tend to have an overarching strategy.

IWP is no different.

“When I set it up, I kind of assumed that this was a retirement option for people,” Inglesfield said.

“But, I would say, somewhere around 70-80% of the people that we are working with don’t want to retire; they want to carry on, but they want support.

“Our proposition is all about continuity. Our view is that these are successful businesses, there’s nothing fundamentally wrong with them, but they lack scale or support.”

The firms don’t need to be “perfect”, he added. “We’re here to give them the support that makes them bigger and better businesses.

“The trick is to keep them going, change as little as you have to, and then you do things where you can add value; this would be compliance, marketing and IT.

“We don’t run these businesses and we don’t want to run them. The owners are perfectly capable of running them. What we do is we deliver support.”

Not a network

Inglesfield was keen to point out that IWP is not an IFA network.

“We own the companies and don’t actually charge for the services we provide,” he added.

“We just provide them because we’re the investor of the companies. We only make money if our investment in a particular business turns out to be a good idea in, say, five years’ time.

“Our long-term plan is to create a national brand that represents independent, local advice.”

Competition

There are many serial acquirers in the UK financial advice sector, such as Fairstone, AFH, Kingswood and Lumin Wealth.

However, Inglesfield said his firm does not find a lot of situations where it is in “direct competition” with any other consolidator because “our model is a bit different”.

“I think people come to us because their primary motivation is to keep their business going and to make sure their clients are looked after,” he said.

“People who come to us, hate the idea that their clients might be forced to go into some investment platform with a higher cost because that’s what the acquirer wants.

“They like the independence of our model.

“Deals fail to progress because people haven’t quite decided it’s the right time to go ahead and sell.”

Warning signs

M&A deals can be very complex and there has to be a high level of due diligence.

This means looking at issues like legacy defined benefit (DB) pension transfer cases, which have caused a lot of problems for small firms.

Inglesfield said: “The first thing is our compliance people do a high-risk screen and they look at high-risk business. They look at active policies and if there is anything that looks fundamentally wrong.

“We take a very careful stance when we acquire a business now, we look at every DB case.

“If it’s not suitable, then we’ll look at how remediable it is. If it’s fundamentally unsuitable, then we’ll look at doing an asset purchase, as long as that is agreed with the Financial Conduct Authority.”

Gunnar and Co deal

Several weeks ago, IWP signed a deal with M&A specialist Gunner & Co to share their experiences and expertise with the financial advice market to help them know how to prepare for the sale of a business.

IWP, alongside financial planner Ascot Lloyd, and conusltancy firm Standards International, will help Gunner & Co deliver a workshop series called Preparing for Exit – How to build value now and exit with the very best value.

The workshops, taking place at locations across the UK, will provide attendees with knowledge on topics; including how to prepare for due diligence, understanding the true value of selling your business and optimising your tax position.

“It is one of those things that you only do once,” said Inglesfield. “Most people I talked to obviously haven’t sold their business before; however, by definition, they’re capable entrepreneurs.

“But there are specific things that you don’t know to look out for.

“There are practical, technical questions, as well as sort of broader commercial questions that need to be asked.”