Anthony Rayner, macro thematic multi-asset manager at Premier Miton, has warned of the dangers of going against an investment trend.

In a commentary note, Rayner noted trends often persist for much longer than investors think, and not just at a market level. He pointed to a ‘range of dynamics’, including geopolitical conflict and the macro environment.

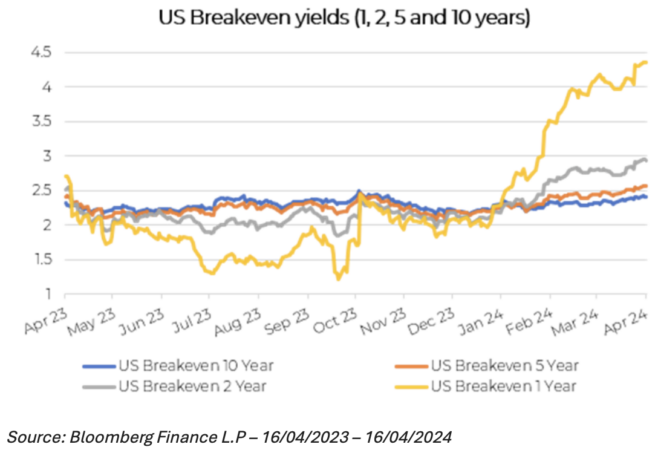

“For example, the Fed famously declared inflation was going to be transitory in 2021, only to reverse that view a short period later, once it was clear that they were wrong,” Rayner said. “Inflation then fell back towards 2%, encouraging markets to assume that it would obediently stay there, ie that inflation would be relatively transitory after all.

“However, the combination of elevated services inflation and a higher oil price has forced investors to renege on the ‘relatively transitory’ view too, and more recently to start pricing in a higher for longer scenario.”

Another example on the macro side Rayner picked out was the “strong consensus” last year that the US was heading for a recession due to higher rates and a sense that the expansionary stage of the cycle had become over extended.

See also: The asset allocator diary: James Sullivan

However, he noted, as with inflation the related metric of US growth turned out to be more persistent too.

Addressing geopolitics risk, Rayner noted that the Ukraine/Russia and Israel/Palestine conflicts have surprised many in their persistency.

“Many investors in the West tended to get caught up in their own propaganda and believed Putin’s days were numbered, whether due to internal or external threat,” he said.

“Turning to the Middle East, many were surprised by the degree of Israel’s response to the Hamas attack and then, forward winding to today, recent actions taken by Israel and Iran suggest that the risk of a regional conflict is increasing. So, again, more persistent than anticipated.”

See also: Söderberg and Partners continues UK expansion with stakes in four IFA firms

Rayner noted that from a portfolio construction perspective, when elevated inflation is a key risk bonds have historically not helped diversify equity risk.

“As a result, and in line with our view that we are in a higher for longer environment, we have held commodities to diversify equity risk, and held short dated bonds for attractive income. This remains an appropriate portfolio construction, with long dated developed government bonds losing money year to date and generally not diversifying equity in sell-offs.”

See also: Bubble trouble: Is the stockmarket riding for a fall?