There was some alarm in 2020 about how covid-19 would affect the way in which people used pension freedoms.

Job losses and furlough put individuals and families under increasing financial pressure, giving rise to legitimate concerns that people would tap into their retirement pots to make up any shortfalls.

But that does not seem to have come to pass, according to the latest flexible payment statistics from HM Revenue & Customs.

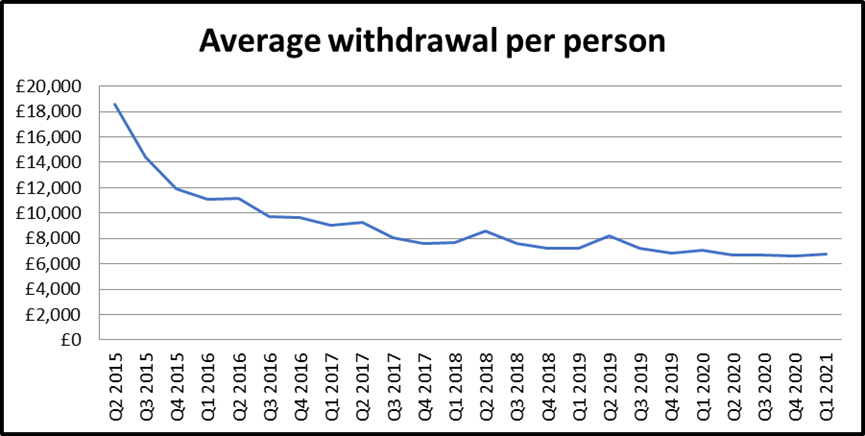

A total of £45bn ($62.8bn, €51.8bn) has now been withdrawn since April 2015, with the average sum of £6,800 taken out during Q1 2021 down 4% compared with the same quarter last year.

Avoided a mass exodus

Ian Browne, pensions expert at Quilter, commented: “The latest pension income statistics show a stable trend as more and more people become familiar with pension freedoms and the possibilities they have with their cash.

“There were fears as the pandemic took root that 2021 was going to be a difficult year and we would see significant spikes in pension access.

“While the number of payments and total value has risen, it is nothing out of the ordinary and clearly the government support schemes are doing their job and helping to prevent a mass exodus of savings that we might otherwise have seen by now.”

Browne continued: “The true economic impact of covid-19 still remains to be seen, however. Unemployment has only ticked up slightly, and with furlough in place until at least September we still face an unknown and uncertain future despite the success of the vaccine rollout.

“This pandemic has changed our financial planning habits for good. There are a number of people who are now newly motivated to plan for their retirement, while others have clearly felt the need or desire to retire early.”

MPAA overhaul

The past year has made clear to Browne and Tom Selby, senior analyst at AJ Bell, that one area in dire need of reform is the money purchase annual allowance (MPAA).

Selby said: “The second quarter of 2021 will almost certainly see a sharp increase in withdrawals, as was the case in each year before the pandemic hit, as savers take advantage of a new set of tax allowances.

“Anyone accessing taxable income from their pension needs to be aware of the impact of the MPAA, which reduces the amount you can save in a pension each year from £40,000 to just £4,000.

“This draconian cut will leave many who have accessed their pension during a time of extreme financial distress – either for themselves or loved ones – severely hampered in their ability to rebuild their retirement pot post-lockdown.

“At the very least the MPAA needs to be increased back to £10,000, but if the government really wants to send a pro-saving message it should scrap the MPAA altogether.”

Browne added: “The MPAA is arguably preventing a cohort from accessing their pensions flexibly but wishing to maintain some level of employment.

“The reduction in your annual allowance after taking just 1p from your pension could materially impact someone looking for short-term financial relief from their pension or those who want to enjoy semi-retirement.

“The pandemic was the perfect opportunity to assess the use of these policies, but it appears the government remain stubborn at keeping it in.”