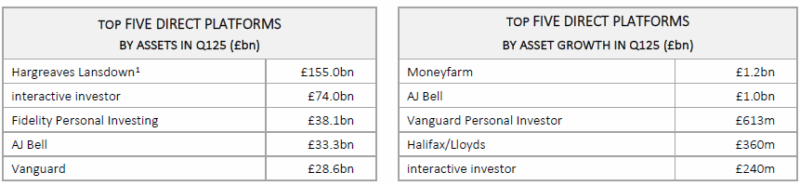

Moneyfarm and AJ Bell both added over £1bn of assets in the first quarter of 2025 to head up Fundscape’s latest rankings of direct platforms.

The top five by asset growth was completed by Vanguard, Halifax/Lloyds and Interactive Investor, as shown below.

In total assets terms, Hargreaves Lansdown remained comfortably ahead on £155bn, followed by Interactive Investor and Fidelity Personal Investing.

See also: Jump in FOS complaints to 141k is ‘an unnerving trend’

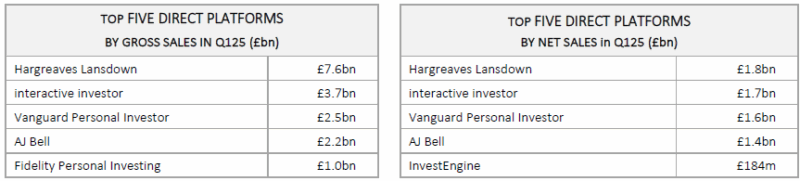

Turning to sales figures, and Hargreaves Lansdown was top for both gross and net sales at £7.6bn and £1.8bn respectively. The Bristol based firm was followed by interactive investor in gross sales and AJ Bell in net sales. Full tables below.

Gemma Maher, head of market insights at Fundscape, said: “Of course, Q1 is only the beginning of the story and what happens in April will have an impact both on performance and sentiment for the rest of 2025. Direct players will have to work harder to convince some customers to invest their hard-earned cash.

“But where there is risk there is also opportunity, and with the growth of cash solutions we have started to see clients use them as a tool to manage market volatility.

“With interest rates coming down and the growing appeal of undervalued UK stocks, it could turn out to be a good year for the direct industry, barring any Trumptastic moves of course.”

See also: Quilter says IHT gifting rule used by just 2% of estates will spike in popularity