International financial services firm Manulife has entered into a joint venture (JV) with the asset management arm of Mahindra & Mahindra Financial Services.

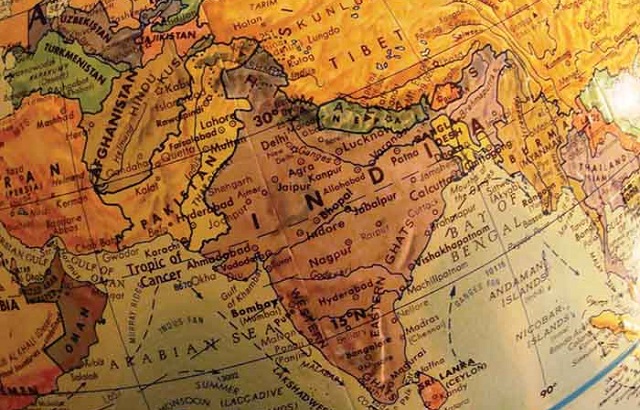

The JV aims to expand the retail investment fund offering in India.

Mahindra AMC will own 51% and Manulife will own 49% of the business.

It will bring together Mahindra’s domestic market operation and Manulife’s global wealth and asset management capabilities.

Expanding footprint

Paul Lorentz, president and chief executive of global wealth and asset management at Manulife Investment Management, said: “Mahindra & Mahindra Financial Services has become a market leader by focusing on meeting unmet customer needs, which mirrors our own experiences in growing our business in Asia.”

The Mahindra-Manulife joint venture will focus on increasing the “awareness and accessibility of market-oriented financial instruments”, which include mutual fund products, to meet the needs of the growing investor base in India.

Drive positive change

Ramesh Iyer, vice chairman and managing director at Mahindra & Mahindra Financial Services, said: “We believe that together we can create a unique value proposition for our retail investors.

“Manulife’s wealth and asset management experience extends over 150 years and they have enjoyed successes across emerging and developed markets.

“We welcome Manulife as a strategic partner, to further drive our efforts at increasing mutual fund penetration in India and driving positive change.”