Global wealth management group Kingswood has purchased Cheshire-based JFP Holdings, the parent company of JFP Financial Services, for £12.4m ($15m, €14.3m).

JFP was established 40 years ago and serves customers across Cheshire, Derbyshire and Staffordshire. The company also provides financial advice to medical professionals, businesses and their employees.

It manages around £360m of assets on behalf of 1,295 clients.

Finances

Kingswood said the M&A deal will be paid for by utilising a £150m funding facility the company secured in October 2022.

The total consideration will be payable over a two-year period, with £7.44m paid upon receiving regulatory approval, and the remainder on a deferred basis subject to the achievement pre-agreed performance targets.

The acquisition will bring total funds under advice/management for the UK and Ireland to over £8.5bn and global assets under advice to around £11bn.

Pipeline

David Lawrence, Kingswood Group chief executive, said: “The acquisition of JFP Holdings will expand our geographical footprint into the northwest region and an affluent south Manchester area. JFP Holdings are a high-quality business that has operated with its affiliate Josolyne & Co, a leading chartered accountancy practice, for many years.

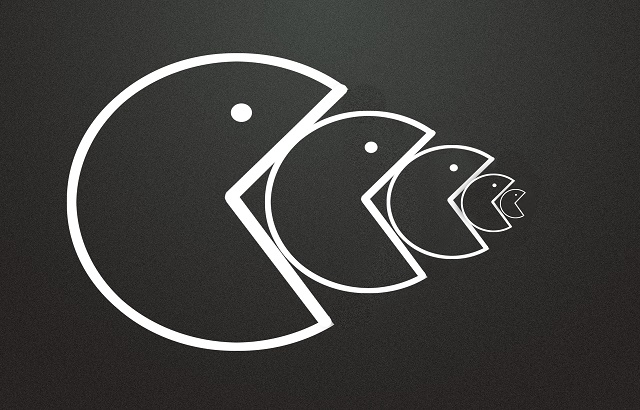

“Our growth strategy is important and we are strongly committed to supporting more clients. We have a further four acquisitions under exclusive due diligence that we expect to close in the coming months, plus a number of additional transactions that are currently under negotiation.”

In November 2022 alone, Kingswood acquired Employee Benefit Solutions for £5.08m; JCH Investment Management for £3.5m and Glasgow-based Strategic Asset Managers for £5.1m.

But the wealth giant’s growth ambitions do not stop at just the UK, as recently Lawrence told International Adviser that Kingswood plans to replicate its UK acquisition spree strategy in the Irish market as well.