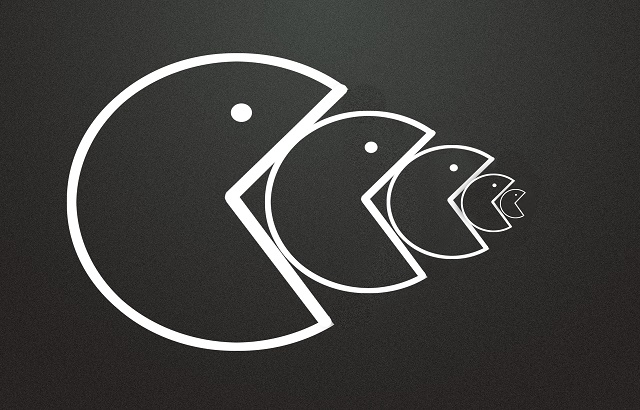

Global wealth manager Julius Baer is looking to bolster its wealth management ranks with period of M&A activity.

This follows the firm’s M&A ban from the Swiss regulator in February 2020, which was lifted in March 2021.

Chief executive Philipp Rickenbacker said that “M&A-based consolidation is clearly a possibility” for the business.

“The current market environment will certainly bring away some of the tailwinds that the industry has had in the last years, and I would expect the coming quarters, if not years, to be more supportive for M&A opportunities.

“We will be ready for those.”

It seems that the relationship management recruitment drive will go forward as planned, but Rickenbacher said the business will implement a hiring freeze on non-relationship management positions as part of a cost discipline exercise triggered by a 26% fall in H1 2022 earnings.

The wealth manager set out its growth strategy in May 2022 with a focus on three areas: acquisitions, the development of in-house talent and recruitment.