The S&P 500 has almost always beaten active managers in the US, leaving investors wondering why they would bother investing in the region actively – especially when passives offer much lower fees for higher returns.

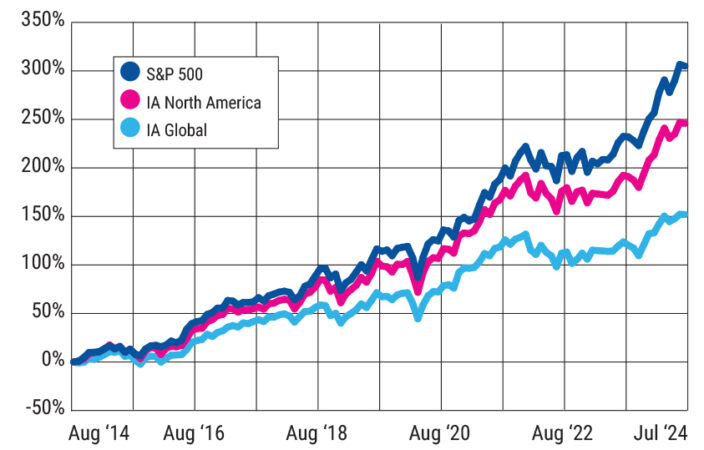

The index increased investors’ savings by 306.4% over the past decade while the average IA North America manager trailed 54.5 percentage points behind. It’s no wonder that most UK investors allocating to the US use trackers – of the £100bn invested in the sector, £58.9bn is held in passive funds, according to the Investment Association (IA).

Multi-asset managers are often confronted with this issue and in most cases opt to simply hold an index tracker to get the majority of their direct US exposure.

It is an approach used by Olivia Geldenhuys, who manages Schroder’s Investment Solutions range. She gets most of her US exposure from passive funds across her portfolios because they stand a much better chance of beating active managers and at a fraction of the cost.

“If we are in a healthy space and markets are upward trending, then we allocate more toward passive investments to benefit from that momentum in marketplaces. But when markets are downward trending, then you typically want to go more active so that you can take advantage of opportunities,” Geldenhuys said.

“There’s also a level of looking at which markets are efficient, and which are inefficient. Typically in inefficient markets, you want to go for active managers versus efficient markets, where you go for index trackers. We essentially identify which are the asset classes where you get the most bang for your buck in going active.

See also: Premier Miton’s David Jane: Should clients ‘income cost average’?

“The US is a prime example of that. Because it’s such an efficient market, you might as well go for something like the HSBC America index tracker, which is a big part of our US exposure. We also have quite a bit in an S&P 400 tracker.”

Because the US is naturally so self-sufficient, Geldenhuys said a big part of her job is “looking for where it’s worth paying for active managers who can outperform”. She only invests in four active US funds, and that is because they give exposure to parts of the market that are not captured in tracker funds.

The Neuberger Berman US Large Cap Value fund, for example, gives exposure that is differentiated from the growthy nature of the US market, while the Artemis US Select and Fisher Investments Institutional US Small and Mid-Cap Core Equity funds pivot away from the mega-cap stocks that dominate most US indices.

Geldenhuys’ only other US holding – the Alliance Bernstein Sustainable US Equity fund – gives her exposure to the market through an ESG lens, which is often lacking from the popular indices.

Yet not a single one of these active US funds came anywhere close to beating the S&P 500 over the past three, five and 10 years. Their purpose for Geldenhuys is not to outperform the market, but offer an uncorrelated return.

Some managers don’t invest in active US funds at all. Trevor Greetham, head of multi asset at Royal London, gets his direct US exposure purely from passives alone.

Instead, he has indirect exposure to the region through active global funds, which offer greater diversification than holding a US-dedicated portfolio. Yet the IA Global sector’s average return of 150.3% over the past decade is half of what the S&P 500 made over that period, again highlighting the efficiency of the index.

Total returns of the IA North America and IA Global sectors vs S&P 500 over past 10 years

“Most doctors smoke and drink, and it’s the same when you ask fund managers about their own personal investment. Most of my personal investments are invested in the funds I manage, but I have been known to own some US trackers just for convenience personally,” Greetham said. “If I was looking for active funds, I’d be more likely to be looking for an active global fund rather than active US funds.”

This is a similar approach to the one taken by Darius McDermott, managing director at Chelsea Financial Services, who gets the majority of his US exposure from the S&P 500. Yet his overall active allocation to the region remains high owing to his holdings in active global funds.

See also: Newton’s Bhavin Shah: What the new macro regime means for multi-asset investors

“We struggle to find active management in the US is the honest answer, as much as I’d like not to feel that way,” McDermott said. “Since we’ve been running money in our fund of funds, our biggest US weighting has always been the S&P 500. Apart from anything else, I can buy it at a much lower fee.

“A lot of our US exposure comes from global funds, but if you looked at our direct North American holdings, it’s much more passive. Yet our overall US weighting across the portfolios is quite high, and much of that comes from the likes of Rathbone Global Opportunities and T. Rowe Price Global Focused Growth Equity.

“I own funds like Polar Capital Biotech and most of the biotech industry in the US, ergo about 80% of that fund is in the States. But I’m not buying it because of its US weighting – that’s just a byproduct.”

This story was written by our sister title, Portfolio Adviser