The industry has welcomed the Financial Conduct Authority (FCA)’s guidance on its rapidly approaching anti-greenwashing rule, but some said firms will be caught off guard as they were hoping for a delay in implementation.

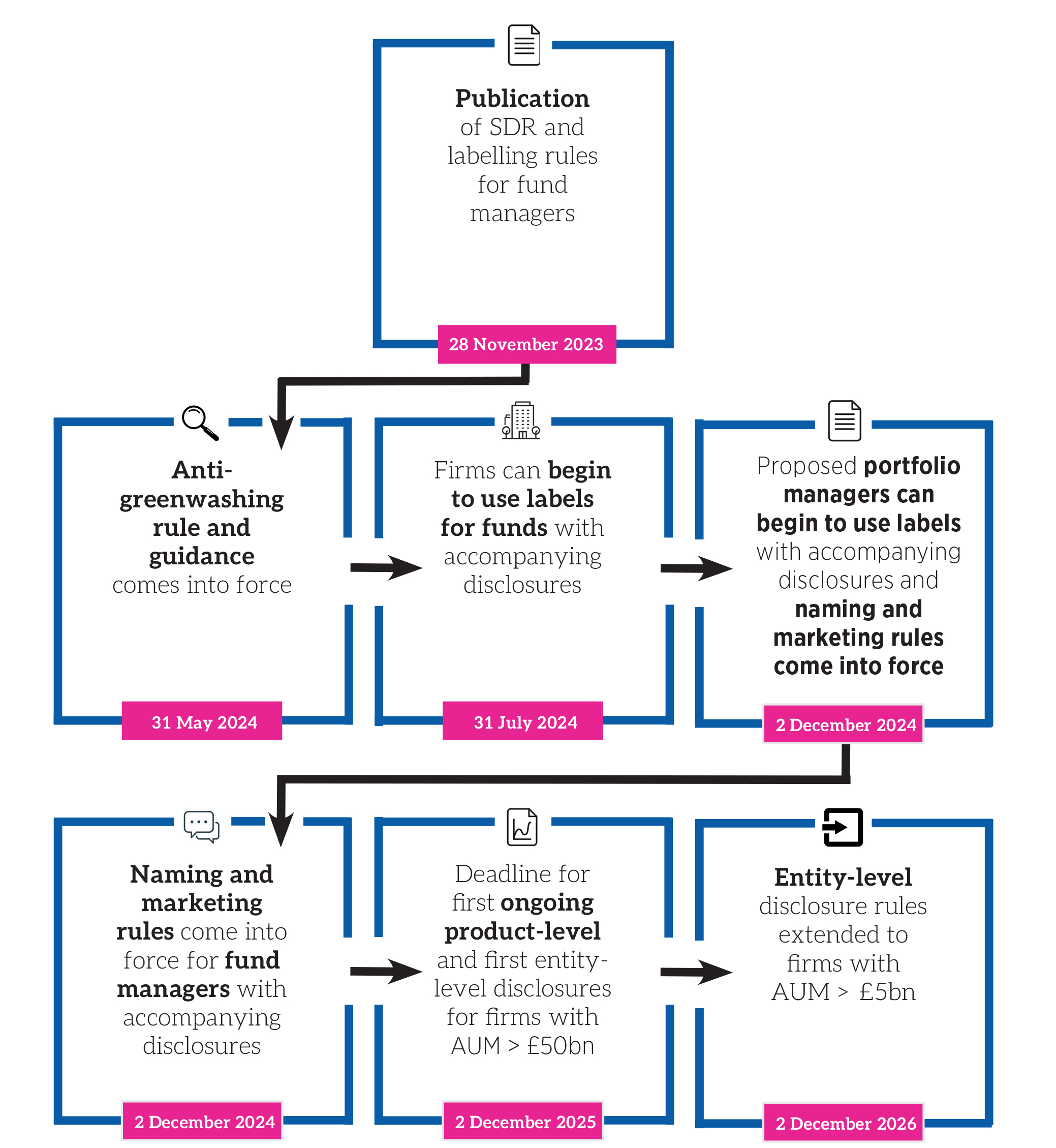

Alongside an announcement of a consultation into the extension of the Sustainability Disclosure Requirements (SDR) to portfolio management services, the FCA issued finalised guidance on its initiative to minimise greenwashing following industry feedback. It also confirmed the deadline of 31 May 2024 as previously announced.

It said the feedback largely called for further clarity on the regulator’s expectations including examples and case studies of good practice, applying to broader sector and social scenarios.

The FCA clarified its anti-greenwashing rule applies when a firm communicates with clients in the UK in relation to a product or service, or communicates a financial promotion (or approves a financial promotion for communication) to a person in the UK.

When referencing ‘sustainability’, firms should ensure the following:

- It is correct and capable of being substantiated.

- Clear and presented in a way that can be understood.

- It is complete and should not omit or hide information.

- It should consider the full life cycle of the product or service.

- Comparisons to other product services are fair and meaningful.

In particular, the guidance said firms should not “overstate or exaggerate a product or service’s sustainability or positive environmental and/or social impact”. It also urged firms to regularly review their claims and ensure they are lived up to.

Additionally, firms should be aware of the “overall impression” they are creating in terms of the images, logos and colours they are using alongside sustainability products or services. If firms are subject to Consumer Duty, they need to test their communications where appropriate and ensure they have the necessary information to monitor customer outcomes.

See also: FCA releases proposals to expand SDR to wealth managers

The FCA guidance ask firms to “clearly and prominently disclose” when only certain conditions apply to sustainability products or if there are any limitations in terms of the data or metrics used.

In terms of comparison, the guidance said this should enable a customer to make informed choices and warned “claims that appear to make market‐wide comparisons, but are based only on a limited sample, have the potential to mislead their audience”. It also cautioned firms to consider claims a product or service has sustainability characteristics, when it may simply be meeting a minimum standard of compliance with existing legal requirements.

‘Rush to look at policies’

James Morris, managing associate, financial regulation at Linklaters, said although firms had started to address the anti-greenwashing rules in their policies, they had been hoping for a delay:

“Though intended to be consistent with existing rules, lots of firms had been hoping for a delay to the FCA’s anti-greenwashing rule and guidance to give time for implementation as they are so broad.

“Firms will already be reviewing how they portray and market the environmental and social characteristics of their products, from fund prospectuses and website content, to product and service claims. Now the FCA has confirmed the rule and guidance will definitely apply from 31 May, doubtless there will be a rush to look at existing marketing policies and guidelines again and firms will be thinking about training to make sure that everyone is familiar with the anti-greenwashing requirements before then.”

The FCA addressed this point: “As the anti‐greenwashing rule will come into force on 31 May 2024, we are bringing the guidance into force at the same time to provide firms with clarity on our expectations when complying with the new rule.

See also: Is greenwashing a big problem for the financial advice market?

“For most firms, the rule does not introduce a new requirement as they should already be ensuring their claims are ‘fair, clear and not misleading’ under existing FCA requirements. In response to feedback to CP22/20, we did not bring the anti‐greenwashing rule into force on the date of publishing the final regime as intended, and instead we allowed an additional six months for firms to prepare if needed. We are therefore not introducing an additional transition period for the guidance.”

Lucy Blake, partner and greenwashing legal expert at Jenner & Block’s London office, had a sterner warning for investment houses, especially those “walking a tightrope between greenwashing and greenhushing”.

“The FCA’s action is part of a wider trend of UK authorities taking action against greenwashing and the message to financial institutions (and other companies) is clear – the temperature is rising and green statements need to be meticulously substantiated.

“Companies face increasing pressure from investors, shareholders, consumers and regulators to operate ethically and sustainably, while remaining profitable.

“However, the more companies say, the greater the risk of saying the wrong thing. Businesses that exaggerate their green credentials, even unintentionally, can face the wrath of regulators, who are armed with hefty fines. Firms can also suffer extensive reputational damage.”

She added although it may be tempting for companies to batten down the hatches and say nothing at all to avoid scrutiny, the companies that remain tight-lipped about how they are mitigating environmental problems risk accusations of misleading investors and the market by obscuring the risks.

“Many companies find themselves walking a tightrope between greenwashing and greenhushing — damned for saying the wrong thing or damned for saying too little. The solution for companies caught in these crosshairs is honesty, transparency and a demonstrable commitment to positive change,” Blake said.

Tight implementation timetable

Meanwhile, UKSIF’s head of policy, Oscar Warwick Thompson, said the organisation welcomed the clarity offered by the FCA in the guidance but also flagged the impending deadline.

“We are pleased to see today’s updated guidance from the FCA on its ‘anti-greenwashing’ rule, which delivers clarity on some areas which had previously caused uncertainty, though we do have concerns on the tight implementation timetable.

“We welcome clarifications around the rule’s application to products and services’ sustainability claims and the additional good practice case studies, which will be helpful to firms as the 31 May deadline now rapidly approaches.

“We fully support the FCA’s efforts to address greenwashing risks and introduce high-quality standards to address exaggerated and misleading claims that fail to meet consumer expectations. The turnaround for implementation is very tight, and we will continue to work with our members to help them get to grips with this guidance and the rule.”

The FCA said it will continue to provide support to industry on “implementation of the regime through stakeholder engagement, including webinars and events” and will keep the guidance under review to consider where it may need to be built upon.

SDR implementation timeline

This article was originally published by our sister title, PA Future