Behavioural analysis is the science of understanding how customers behave and has traditionally been used as a technique to drive up sales, retention, and market share.

But since the introduction of the Consumer Duty – behavioural analysis can be used as a powerful tool to support firms in evidencing and complying with the regulation.

By gaining actionable insights into how customers make decisions, perceive information, and interact, firms can tailor their financial products and services to better meet their customers’ needs and protect their interests, thus improving customer journeys, experiences and outcomes.

Consumer Duty guidance is not prescriptive, but does outline what data could be included, and splits this across ‘Conduct Data’ which includes behavioural analysis and colleague and customer feedback.

Because the Financial Conduct Authority (FCA) has provided guidance and not templates, it’s subjective and open to interpretation. As a result, there will be a wide variety of different reporting styles within the annual reports, which were produced by firms for the first time on 31st July 2024. But time will tell as to what passes the FCA scrutiny.

Providing practical support for Consumer Duty

There are many techniques available in the field of behavioural analysis – but a few can be key to support Consumer Duty compliance.

Web Analytics: Web analytics such as Google Analytics are increasingly used to gain metrics relating to online journeys such as what device is being used, duration of visit, whether an action is completed within one or multiple visits, where customers drop out of the journey etc. Practical examples include looking at how long it takes applicants to answer questions and identifying questions that take longer to answer which may indicate a lack of understanding.

See also: Simplify Consulting’s Monserrate: Hitting the target on customer complaints

Analysing Data Patterns: Analysing data patterns such as missed payments, erratic account activity, or high levels of customer service interactions can help highlight problem areas. For example, if a customer phones the contact centre multiple times to discuss the same topic, this may demonstrate a lack of understanding. Capturing and utilising such data can also be used to proactively identify vulnerable customers, rather than waiting for them to identify themselves to the firm.

Customer Surveys, Feedback & Complaints: Conducting customer experience surveys to obtain metrics such as Net Promoter Score (NPS) and Customer Effort Score (CES), requesting feedback at onboarding and other key points during the life of the relationship, as well as gathering data from complaints are all rich sources of quantitative and qualitative data for insights on customer experience and satisfaction, as well as their perception of value. These metrics and any associated commentary can be used to identify common themes, the root causes of dissatisfaction, areas for improvement and to benchmark performance against industry standards. As an example, we have experienced firms that use NPS results to proactively contact detractors to understand the source of their dissatisfaction, which can also yield quality information that can then be used for improvements.

User Testing: User testing gives the added benefit of being able to directly interact and gain feedback from different segments of the firm’s customer base. It can be carried out using various techniques including conducting step-by-step analysis or observation of a customer’s interaction with a product or service to simulate the user experience for things like online journeys and customer communications. This provides a wealth of insights into customer habits, preferences, emotions and decision-making process, which can be used to identify usability issues such as areas where customers struggle to complete tasks or understand instructions.

Depending on available budget and technology, additional methods such as eye-tracking studies could also be used. This helps to track where customers focus their attention on websites, communications etc so that the content, layout, and format can be optimised to improve engagement and understanding. This can also help with measuring and evidencing customer understanding.

Actionable Insights

The data collated must be analysed and interpreted correctly to provide meaningful business intelligence, identifying any areas where customers are getting poor outcomes.

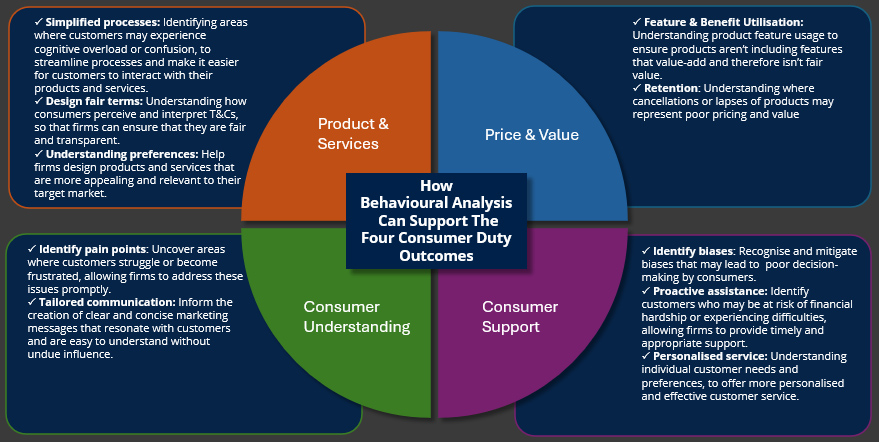

This can then be used to make targeted improvements aligned with the four Consumer Duty outcomes of Product and Services, Price and Value, Consumer Understanding and Consumer Support.

See also: Risk Capacity and Capacity for Loss: Defining the Difference

The business intelligence can also be fed into regular Management Information and used to demonstrate what has been identified and addressed as part of Consumer Duty reporting.

Considerations

There are some drawbacks of using behavioural analysis. The cost and effort of employing different techniques can be problematic, particularly if using third party services.

One risk to be mindful of is misinterpretation of data. For example, how to differentiate between someone who needs longer to read a page than someone who is taking a long time to decide, something which user testing in-person as opposed to remote data collection can help with.

There are also ethical and privacy considerations to consider. Firms must be transparent about data collection practices and, where necessary, obtain explicit consent from consumers in order to remain compliant with GDPR.

Conclusion

Behavioural analysis can provide an opportunity to keep up with continuously evolving customer behaviour and expectations and gain a much deeper understanding of customer preferences and motivations, as well as how they interact with products and services.

It will be crucial that alongside gathering the data, firms also evidence the actions they are taking off the back of these insights. Obtaining the full picture can then help to inform product development and strategies for marketing, communication, and customer services.

All of which will help improve customer engagement, understanding, decision making, foster better financial well-being and ultimately better outcomes.

Nina Cherry is a wealth consultant at Simplify Consulting