Twice in the past couple of months, I have been contacted about difficulties financial advisers are experiencing transferring their client’s pensions out of Guernsey.

Both cases are hitting the same barrier.

The Guernsey-based trustee requires a letter of undertaking to be signed by the receiving scheme before it will authorise the transfer.

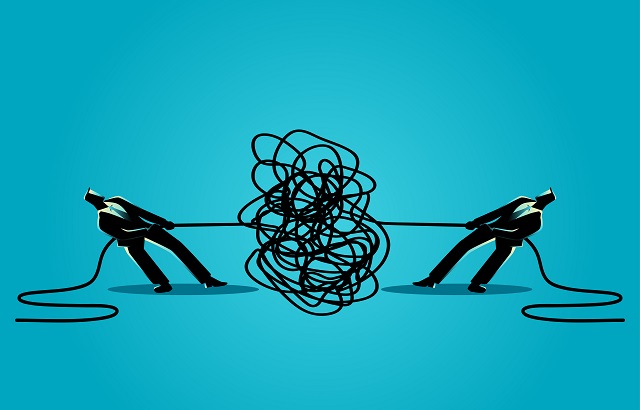

The receiving companies, however, are not willing to sign the letter; as it places any potential liabilities at their feet.

Ultimately, this leaves the client trapped in limbo.

Conflicted parties

Speaking to International Adviser, Doug Melville, principal ombudsman and chief executive of the Channel Islands Financial Ombudsman (CIFO), describes the situation as “messy”.

“The circumstances surrounding a pension transfer can be very broad, multi-jurisdictional and multi-party.

“All the parties involved in serving the customer’s need are potentially conflicted and stand to benefit from the change, or the refusal to implement the change.”

He adds: “Pension provision in Guernsey is wrapped up in trust law. The trustee, as the fiduciary, has a higher duty in law than the adviser.

“So, it’s not unreasonable for the trustee to get evidence that the transfer is in the best interests of the client.

“If the receiving firm refuses to sign a letter of undertaking, it indicates that the receiver may want the assets but not the potential liability.

“The transferring firm can process the transfer without the letter, but it creates a potential liability for them.

“Ultimately, it comes down to two firms seeking to avoid potential liabilities.”

It is because of this confusion that the CIFO took the decision that cases of this nature may be better resolved by the court.

“We cannot compel the provision of evidence from other jurisdictions, so we were not able to get all of the information we needed to reach a conclusion.

“The courts can,” Melville says.

Hotel California?

One of the advisers involved in one of the cases mentioned above is Phil Billingham, director of Perceptive Planning.

His client has experienced significant delays in trying to get his pension transferred.

The receiving scheme has declined to sign the letter of undertaking, which has effectively ground the process to a halt.

“The company is in a well-established and highly-regulated jurisdiction. There is no good reason for the pension trustee to refuse the transfer,” he tells IA.

It is a situation that has Billingham severely questioning Guernsey’s effectiveness as a jurisdiction.

“It seems like the Guernsey Financial Services Commission is taking the Swiss financial regulator’s approach of protecting the companies and not the clients.”

Billingham says he is particularly concerned about the lack of scrutiny of how the funds were transferred to Guernsey in the first place.

His explains that client was mis-sold.

“It would seem that money can travel to Guernsey but is not allowed to return.”

Abiding by Guernsey trust law

Roger Berry, managing director of Guernsey-based pension trustee Concept Group, takes issue with two of the points raised.

“It’s a matter of perspective. We have thousands of scheme members and do many transfers out each year.

“I only know of two cases this year where there are issues with the undertakings that haven’t been resolved one way or another.

“We transfer to any number of schemes in the UK, so I don’t agree that anyone is trapped. If the receiving scheme doesn’t like the terms, the advisers can go to another provider,” he tells IA.

Berry accepts that it is a tricky situation, but says Guernsey trust providers must abide by Guernsey trust law.

“It is what we are examined on in court.

“The undertakings are there to protect the trustee. Firms could experience issues with their PI insurers if they opt for a quiet life and just process transfers.”

In his view, pension transfer problems are a “fairly limited issue”, especially given there are providers willing to sign the letters of undertaking.

No judgement substitution

To get to the bottom of the situation, International Adviser reached out to the GFSC to better understand its stance on pension transfer delays.

A spokesperson said: “Pension transfers are not necessarily straightforward and Guernsey pension providers; to the extent they act as the trustee of the pension funds, which will often be the case, have an obligation to ensure that they are acting in the best interests of the beneficiaries of the trust – the pension scheme members.

“They are entitled to question a request for a transfer where they are concerned, inter alia, that the request may arise because of a financial adviser manipulating a pension scheme member in the hope of churning the member’s pension to make a significant short-term profit.

“That said, there must be a balance to such scrutiny by Guernsey pension trustees and in cases where the trustee has no reason to believe that the scheme member is not of sound mind, having appropriately checked the pension member’s rationale for the transfer and the bona fides of the new trustee, they should respect that individual’s reasonable expectation of being able to freely choose where and how to conduct his or her pensions savings and effect a transfer without undue delay, unreasonable charges or conditions in relation to the transfer.”

The spokesperson added: “They cannot unreasonably substitute their judgement as to the pension member’s best interests, save in unusual circumstances, as we live in a free society.

“They must also take care not to privilege their commercial interests over their fiduciary duties under the trust law and their legal obligations to adhere to Bailiwick pension regulations.”

Changes to the rules

The GFSC conducted an initial review of pension regulations between December 2017 and February 2018.

Following which, it determined that it was appropriate to introduce some new rules for pension providers.

A consultation took place in 2019, the final rules were published on 18 February 2020 and will come into force on 31 December 2020, the spokesperson explained.

They explicitly state:

- Licensees must pay due regard to the interests of scheme members and beneficiaries and treat them fairly (2.1);

- Transfer requests and information about transfer values should be processed promptly and accurately and should not be unreasonably delayed;

- Licensees must not impose unreasonable conditions on scheme members who request a transfer (2.12).

The GFSC spokesperson continued: “All pension providers are obliged to abide by these rules once they come into force and the Commission encourages all pension providers to take heed of them during the remainder of 2020.

“Individual complaints about pensions will normally be considered by the Channel Islands Financial Ombudsman who generally has powers to award compensation.

“The Commission would generally become involved if it was clear that there were consumer treatment issues which the ombudsman was not best placed to deal with through adjudication on individual cases.”

Cause for optimism

The comments from the GFSC spokesperson were welcomed by Billingham, who said it showed an “intention to improve” the current situation.

“It appears as though, and this may be Brexit driven, that Guernsey is shifting towards a more EU-aligned consumer protection stance and away from the Swiss approach.

“But the proof will be in the pudding. If companies don’t change and adopt the new rules, the regulator has to step in and prove it has teeth.”