Global debt levels reached an all-time high this year, making an allocation to gold within portfolios a necessity, according to Jupiter Asian Income manager Jason Pidcock.

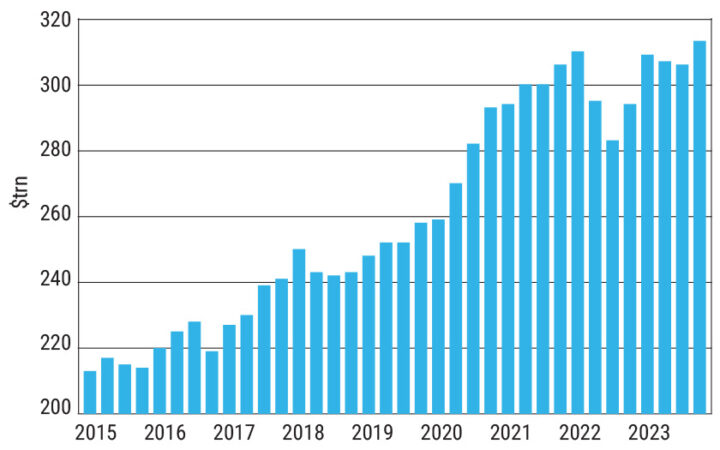

Debt peaked past $313trn at the start of the year after borrowers added around $100trn of new debt to their books since 2015, according to the Institute of International Finance (IIF). It noted that $89.9trn of that was made up of government debt.

These lofty debt levels made Pidcock cautious and led him to make gold mining company Newmont the sixth largest holding in the portfolio, representing 4.8% of the £1.9bn fund.

“Fiscal policy globally is very loose, and that is a concern,” he said. “Budget deficits – even when economies have supposedly been strong – have been way too high. And that’s why we invested in gold mines.

“We thought the gold price is probably going to go up because these paper currencies are just going to get more and more diluted as governments have to print more money to pay the interest on the debt they’ve accumulated.”

Global debt (in USD) since 2015

Pidcock’s exposure to the precious metal may not seem high, but he said “everyone should have some exposure to gold, whether it’s as an insurance policy or just sensible diversification”.

And an allocation to gold may be all the more important now that its purpose within portfolios is rivalling the role traditional held by bonds.

“If there was a new geopolitical shock, I think gold would be seen as a place to hide,” Pidcock said. “Government bonds are traditionally seen as that, but if that political shock required a lot more government expenditure, then government bonds might not be the safety net that they have been in the past.

“We saw in Covid that government expenditure ballooned and created a lot more inflation, which wasn’t great for bonds, and that’s probably where we are again now. The first reaction of governments in a crisis is to spend even more money, so I would say everyone should have a little bit of gold.”

See also: Head to head: Pedal to the metal

This was echoed by Sotirios Nakos, multi-asset fund manager at Aviva Investors, who agreed the precious metal was encroaching upon the downturn protection function historically reserved for fixed income.

“Gold is challenging the traditional role of bonds in portfolios,” he said. “While gold is generally negatively correlated with real interest rates — meaning higher real rates increase the opportunity cost of holding gold —this relationship is not stable and varies over time.

“Particularly during periods of high inflation, the real rate effect on gold becomes smaller, making it a valuable asset in a diversified portfolio, potentially rivalling bonds. For cautious portfolios, however, the volatility associated with gold can limit its overall allocation.”

While gold does have its appeals as a safe haven in a high debt world, Rathbones multi-asset manager Will McIntosh-Whyte questioned whether its rallying price can be maintained.

An ounce of the precious metal will set investors back £1,951 today, which is 25.5% more expensive than it was a year ago. But McIntosh-Whyte said its price may have been artificially accelerated by central bank buying.

See also: Trium: Why geopolitics will keep pushing gold prices higher

The World Gold Council estimates that central banks bought 2119 tonnes of gold in 2022 and 2023, which was three times higher than they had in the prior two years combined. And they pushed their buying even higher in 2024, purchasing an additional 484 tonnes in the first half of this year.

A slowdown in the central bank buying that has fuelled a powerful rally could see gold’s soaring price come to a standstill, according to McIntosh-Whyte. Fixed income could therefore keeps its seat as the best protector in the case of a downturn.

“My issue with gold is that it has obviously had a very strong run,” McIntosh-Whyte added. “It’s always tricky to rationalised movement, especially when there’s been a decent amount of buy from places like China. With a weak property market, I think a lot of Chinese households are turning to gold, and the same is happening in Japan in light of the country policy that we’ve seen there.

“There has just been a significant amount of central bank buying over the past year or so – it’s my view that US treasuries are a more reliable instrument to help protect portfolios in the majority of scenarios.”

See also: Interest rates: Tough decisions ahead for central banks

Yet the US government’s towering debt levels have not gone amiss on McIntosh-Whyte. The nation’s $35.3trn of debt accounts for around a third of all global government debt, making McIntosh-Whyte slightly more sceptical of his US treasury holdings.

“Earlier this year, we started slightly diversifying our exposure away from the US and into a number of European nations where we see the fiscal situation being a bit stronger, and where we’re more relaxed about the inflationary environment,” he said.

“But that’s coming from a position where we’ve actually held a lot. So I’m not rushing to sell my US treasuries to put it into gold – I’d rather just keep a little bit of dry powder.”

This story was written by our sister title, Portfolio Adviser