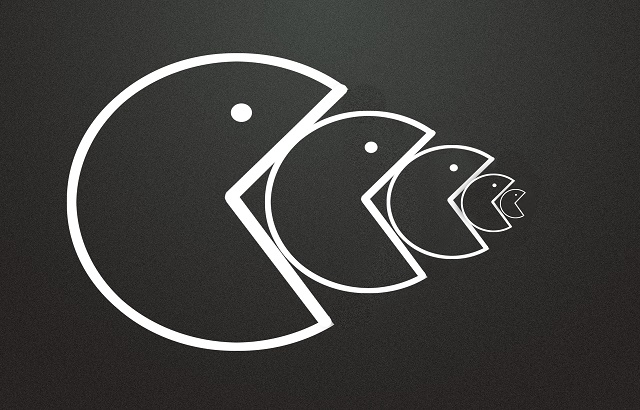

It is undeniable that the UK financial advisory market has seen a skyrocketing number of acquisitions in the last few years.

Rising regulatory pressure, fees, compliance and ageing advisers are just some of the reasons why many businesses have put themselves up for sale.

And the competition has gotten fiercer, with surging valuations and players from around the world looking for a piece of the UK market.

While we have seen big players get even bigger, is consolidation getting out of control or is there still a need for it within the sector?

Fragmentation

According to Louise Jeffreys, managing director at Gunner & Co, the UK advice market is “still predominantly made up” of firms with five or under advisers and “the principals of these firms are typically in their 50s and 60s”.

“So, whilst it appears on the surface that a large amount of consolidation has been made over the last five years, there remains a significant supply of small firms ripe for consolidation. Indeed, since retirement tends to be the key driver for sale, business owners need the consolidation market to continue, and fortunately there appears to be enough appetite for investment to maintain it,” she told International Adviser.

Kingswood chief executive David Lawrence believes that the advice market is “one of the most fragmented of all financial services sectors in both the UK and internationally, and the market has shown itself to be able to support dominant players such as St James Place as well as sole practitioner IFAs alongside each other”.

As a result, he thinks the consolidation that has taken place is “still a small amount of the overall participation” and that it would be wrong to say that there has been too much.

“A good consolidation often derives not only a great outcome for the firm’s principals, but also for its clients, with larger firms having access to capabilities such as technology that can transform a client’s experience,” he told IA.

Appealing opportunities

Both Jeffreys and Lawrence said that there is no doubt valuations and prices have gone up in the last few years.

Jeffreys said: “We have seen a steady rise in multiples of both recurring income and adjusted Ebitda over the last three years.

“Competition is fiercest for multi-adviser firms with significant profits, as more and more buyers look to complete less, but bigger deals. The smaller end of the market remains well served by regional businesses.”

Lawrence believes one of the reasons for this is the appealing “size of the advice gap” but also the investment opportunities brought by the pandemic.

“During covid, the sector has, by virtue of sticky recurring income streams, shown a strong resilience to headwinds. This has led to an increase in the number of trade buyers and investors seeking opportunities in the sector.

“This coupled with an increase in firms wishing to sell, be it due to increased regulation or another reason, have led to an interesting interaction between supply and demand.”

What acquirers look for

Kingswood has been among one of the most active players in both the UK and international wealth markets; and more often than not cultural fit and assets under management are cited by acquirers as the main reasons for buying firms, but are there any other criteria?

Lawrence said that “cultural fit transcends everything else”, but there are also other factors that come to play once compatibility is established.

He said these include:

- Location – does the target complement and an existing or create a new presence in a certain territory?

- Growth – following the acquisition, can an acquirer fuel accelerated growth?

- Vertical integration – are there opportunities for cross selling?

Gunner & Co’s Jeffreys agrees as cultural fit is still top of the list for many acquirers.

“Each buyer has a unique set of acquisition criteria, aligned to its culture, strategic goals and location,” she said. “Factors such as investment approach, charging scales and client location all contribute to the attractiveness of a firm to an individual buyer. Future plans of the principal, along with team make up also play a part.

“There are so many permeations across a varied buyer market, it’s unusual not to find a good fit for a seller with realistic expectations.”

Attractiveness

One of the most attractive offerings a firm looking to sell can have are DFM capabilities, especially if they can complement the acquirer’s propositions.

At the same time, defined benefit (DB) pension transfers have become a major red flag as they carry legacy liabilities which many businesses will want to stay as far away as possible from.

So, how can acquirees position themselves when looking to sell?

“In house DFM capabilities are attractive to purchasers that already have this capability as there are usually synergy benefits, less so for those that don’t,” Lawrence said. “With exposures to DB transfers, firms should be up front about this and be able to clearly articulate background, show clear client records and a robust process – when well-run, this then often comes down to the acquirer’s appetite.

“Acquirees also make themselves attractive by being clear as to what they want from the sale and by flagging any red lines. For example, are they happy to move from an advisory model to an in-house DFM? Their personal goals with regards to the company’s exit is critical here too.”

Jeffreys added: “There are some core trends in attractiveness of a business coming to market, including average portfolio size of clients and profitability per client; overall size of firm and simplicity of client proposition.

“DB transfer liability is a big hot potato currently, having a significant negative impact on the attractiveness of a business. Sellers with significant DB transfers as a minimum should understand the structure of any potential sale (almost certainly it will be structured as an asset sale), including the tax and ongoing liability implications. “