The Financial Conduct Authority (FCA) is keen to find out more about the defined benefit (DB) pension transfer market between April 2020 and September 2020.

It has sent out a survey to 1,653 firms with DB transfer permissions for a data request on their transfer business during the months affected by the coronavirus pandemic.

International Adviser understands that this is a similar data request to its previous survey in July, however this one is will allow the FCA to collect additional data on how covid has affected demand for DB transfer advice.

Any firms who failed to respond to the first request will be required to complete the latest request for the full period from October 2018 to September 2020.

Firms must submit their responses by December 11.

This comes days after IA reported that there have been just 11 FCA investigations into DB transfer misconduct in 2020.

Response

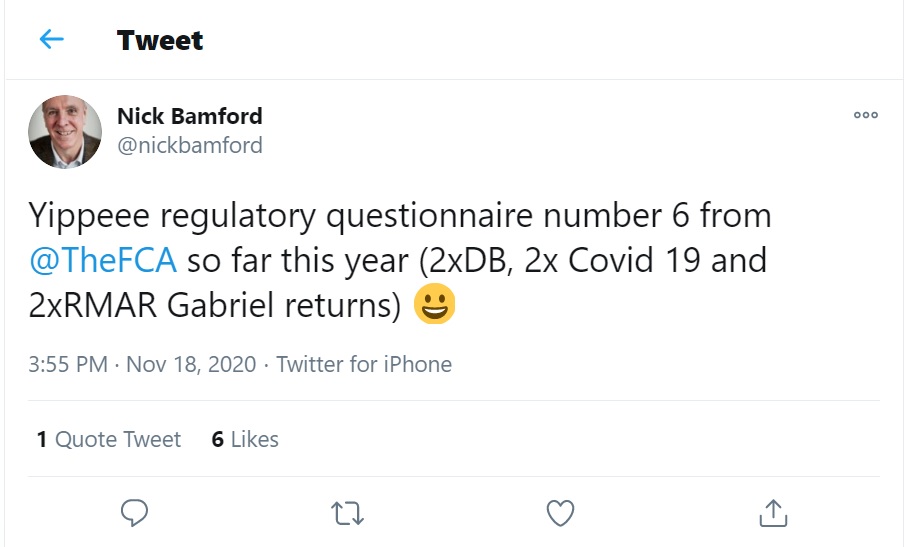

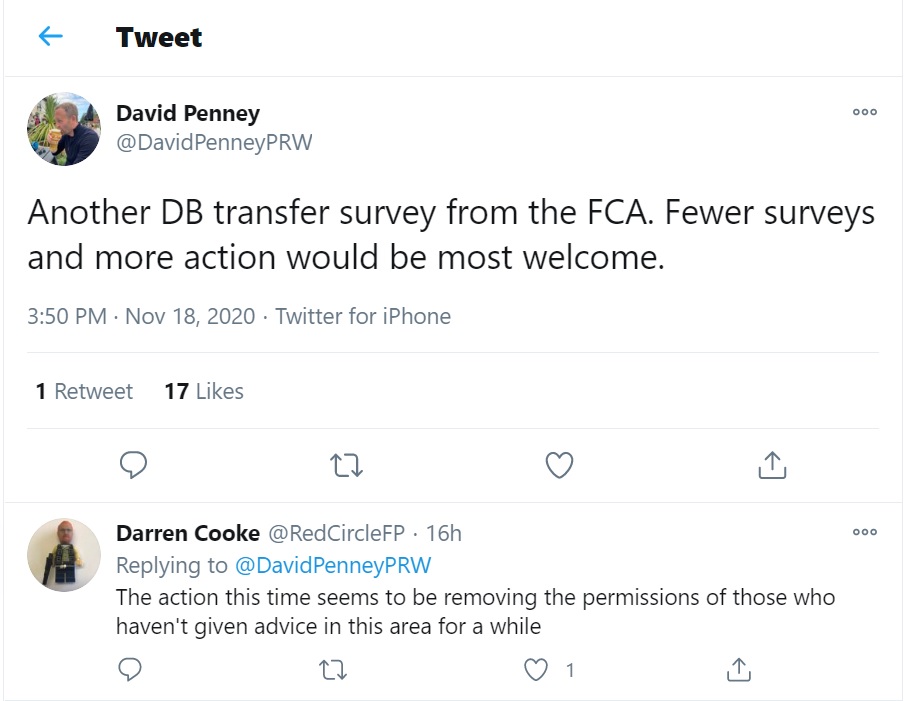

Advisers took to social media to discuss the latest DB transfer survey from the FCA.

Nick Bamford, executive director at Informed Choice, said on Twitter it was the sixth questionnaire he had received from the FCA this year.

David Penney, chartered financial planner and director at Penney Ruddy & Winter, also said on Twitter: “Fewer surveys and more action would be most welcome.”

Darren Cooke, chartered financial planner at Red Circle Financial Planning, replied to Penney’s statement and said: “the action this time seems to be removing the permissions of those who haven’t given advice in this area for a while”.

Previous survey

The UK watchdog is keen to “understand the shape of the entire DB transfer advice market”.

This is the second DB market request the FCA has sent out this year after it sent one to 1,965 firms in July covering the period October 2018 to March 2020.

The previous survey asked following questions:

- The number of clients the firm recommended to transfer;

- The number of clients the firm recommended not to transfer;

- The number of clients the firm allowed to proceed as insistent clients;

- The number of clients who opted out in order to transfer;

- The number of clients who discussed a pension transfer with the firm but did not proceed to receiving full advice, eg that did not proceed to full advice through the firm’s triage process;

- The average transfer value the firm advised on;

- The percentage of the firm’s total income that results from providing pension transfer advice;

- The number of clients who transferred but did not engage with the firm for ongoing advice;

- The number of pension transfer specialists at the firm;

- The range of charges clients were charged for the recommended investment; and;

- We will also be asking some information around the firms professional indemnity (PI) insurance.

Advisers anger

The FCA’s work on the DB transfer market has led to a rise in PI premiums and regulatory fees.

Insurers continue to exit the PI market due to the nature of legacy transfers and the Financial Services Compensation Scheme (FSCS) levies have incresed to fund the number of DB cases.

The industry has voiced its anger over the last few months, as some small firms can’t afford to stay in the advice sector.

Recently, James Pearcy-Caldwell, chief executive of Aisa Group said the FCA is “out of control”.

Back in April 2020, Phil Billingham, director at Perceptive Planning, took to social media to lament his PI cover rising by 400% despite no claims or DB transfers.

IA also interviewed Phil McGovern, director of MPA Wealth Management, about rising regulatory fees and levies, and he said that the industry lacks a “real lobbying group” to help advisers.

But, unfortunately, the FCA recently told a treasury select committee that the watchdog can’t give “specific comfort” of when FSCS levies will fall.