The Financial Conduct Authority has proposed an extension of its Sustainability Disclosure Requirements (SDR) to encompass wealth management services such as model portfolios (MPS) – albeit with a reduced threshold for assets defined as sustainable than previously outlined.

In the SDR policy statement released in December, the FCA excluded discretionary portfolio management with the regulator saying said it would consult on bringing that into scope further down the line.

Following this consultation, in the document titled CP24/8 proposing to extend the SDR regime to portfolio management released today, the FCA is proposing to extend SDR and the investment labels regime to all forms of portfolio management offerings such as model portfolios, customised portfolios and/or bespoke portfolio management services that are aimed at retail investors.

Previously, the FCA said it had received feedback the proposed approach to labelling would not be suitable for portfolio managers who could only use labels if 90% of more of the value of the portfolio invested in other labelled funds. However, these portfolios tend to hold overseas funds and direct equities, which are not labelled, alongside UK funds.

SDR fund labels

“Stakeholders fed back that most portfolios are diversified and would be unlikely to invest only in UK funds with labels,” said the paper. “Many stakeholders asked us to take a similar approach to funds whereby the manager could assess all assets in the portfolio against the criteria for labelling. So, we decided to consult on proposals that follow a similar approach to the final rules for fund managers.”

As a result, the FCA is proposing that “portfolio management offering can use a label if at least 70% of the value of assets within the portfolio are invested in accordance with the sustainability objective, and the other qualifying criteria are met”. This level brings portfolio management in line with fund’s 70% threshold.

See also: – Passives to be ‘significantly underrepresented’ in SDR labels

The FCA added portfolio management offerings directed at retail investors are subject to the naming and marketing rules – where they were previously exempt.

Further, firms providing portfolio management services “will be required to produce consumer-facing disclosures if using a label or sustainability-related terms without a label, publishing them on their websites, or relevant digital medium, or providing them to their clients”.

The FCA also asks firms to produce pre-contractual disclosures and ongoing product-level disclosures if using a label or sustainability-related terms on their website or relevant digital medium – previously firms were not required to produce pre-contractual disclosures but instead asked to provide access to the pre-contractual disclosures for the underlying in-scope products.

Entity-level disclosure and rules for distributors remained unchanged.

The FCA paper commented on the aims of the changes and expansion to portfolio managers: “The measures should increase transparency in the portfolio management market, contributing to our objective of enhancing market integrity. Clear and accessible information and labels should help consumers to better navigate the market and understand their investments, enhancing consumer protection.

“Additionally, introducing a clear framework for firms to assess the sustainability credentials of their products consistently, and be more transparent about those credentials, should help facilitate better competition between firms in the interests of consumers.”

Sacha Sadan, director of ESG at the FCA, added: “Confirming the new anti-greenwashing guidance and our proposals to extend the SDR and investment labels regime are important milestones that maintain the UK’s place at the forefront of sustainable investment. Our good and poor practice anti-greenwashing examples will help firms market their products in the right way.”

This is not the first time there have been changes to SDR in light of concerns around portfolios holding varied strategies: in the updated reiteration of the SDR rules published at the end of last year, the FCA addressed concerns around labels for multi-asset funds by introducing a fourth label to sit alongside Focus, Improvers and Impact – Mixed Goals could be used by fund managers investing in multiple different asset classes. In this consultation, the FCA has addressed how discretionary fund managers will use the labels.

The FCA is seeking feedback by 14 June 2024.

‘Avoiding greenhushing’

Gemma Woodward, head of responsible investment at Quilter Cheviot and member of the PA Future Committee, said extending to wealth managers was the “logical next step” for SDR.

“This is a far-reaching piece of regulation from the FCA and as such it requires careful navigation. As the industry evolves, additional clarification on what can and cannot be said, particularly around the naming and marketing of funds and portfolios, will be crucial. This works both ways in that we want to avoid ‘green hushing’ as much as preventing greenwashing. This is where an investment underplays its sustainable credentials so as not to inadvertently overstep the mark. It is a phenomenon already seen in the US and it is vital that we do not see if creep into the UK.

“For advisers, this also underscores the importance to be up to speed and trained in this area of investments. Clients will increasingly be asking about or for sustainable related investments, and as such the advice industry needs to have the confidence and skills to have those conversations. The FCA is working with advisers to help open these communication channels, but more needs to be done by everyone given the rules will come into force imminently. Given the rise in the use of model portfolios, this gives advisers another good opportunity to review their practices around sustainable investment.”

George Latham, managing partner of WHEB Asset Management, added portfolio managers should regard the 70% threshold as a minimum requirement not a target: “Given the importance of model portfolio services (MPS), it is critical that the FCA extend the Sustainability Disclosure Requirements (SDR) to this part of the market. We are pleased to see the consultation paper and the strong degree of alignment with the Policy Statement PS23/16 including on thresholds, consumer disclosures and timelines.

“We understand the pragmatic approach of treating each underlying fund as an asset, but the 70% threshold that applies to underlying funds should be seen as a floor and not a ceiling in our view. Noting the FCA’s comment that a label on its own is not an absolute measure of sustainability, WHEB will continue to provide all the underlying data on our investments that will be needed by MPS providers to underpin their use of the sustainability labels.”

Mollie Thornton at Parmenion welcomed the decision to expand SDR to wealth managers but highlighted some questions remain about the treatment of cash and government bonds in portfolios:

“It definitely makes sense that the new sustainability labels should apply to DFMs, as well as funds. This should be a real positive for advisers and their clients to have confidence in the sustainability credentials of their portfolio as a whole,” she said.

“The big questions which remain are how asset classes like cash and government bonds held in sustainable portfolios will be treated for the purposes of labelling, and also offshore funds which are currently outside of the regime. It’s really important that sustainable investors have the full range of asset classes and funds available to construct well-diversified, risk-controlled portfolios.”

Oscar Warwick Thompson, head of policy and regulatory affairs at UKSIF, commented: “It’s great to see FCA consulting on the extension of the SDR to portfolio management services, which provides clarity for an important part of the investment market. We saw risks in the original proposals in the CP on potentially very few portfolio management services being able to qualify for the labels. Now we are committed to working with the FCA and others to ensure other gaps are addressed, such as gaining clarity on the approach to overseas funds and pensions products.”

Meanwhile Raza Naeem, financial regulation partner at Linklaters, commented on the timedframe: “Overall, the FCA’s proposals to extend the SDR regime to portfolio managers largely mirrors the proposals for UK funds. Helpfully the FCA has moved away from the initial proposal of separate accounts only being able to use a label where 90% of the portfolio is invested in labelled / label eligible products and have instead now imposed the same 70% eligibility requirement as for funds. The tricky part though is the very tight timeframe – as the FCA expects UK portfolio managers to comply with the naming and marketing rules from 2 December 2024 as well (i.e., at the same time as UK fund managers), when in fact the final rules will only be published in the second half of 2024.”

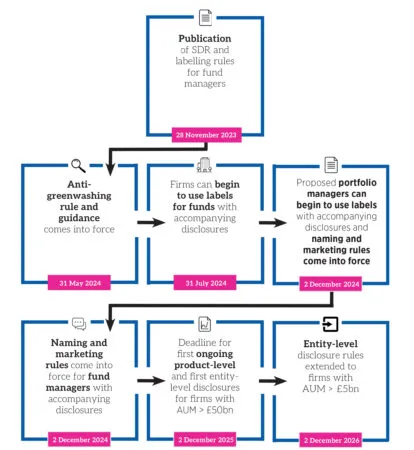

SDR implementation timeline

This story was written by our sister title PA Future