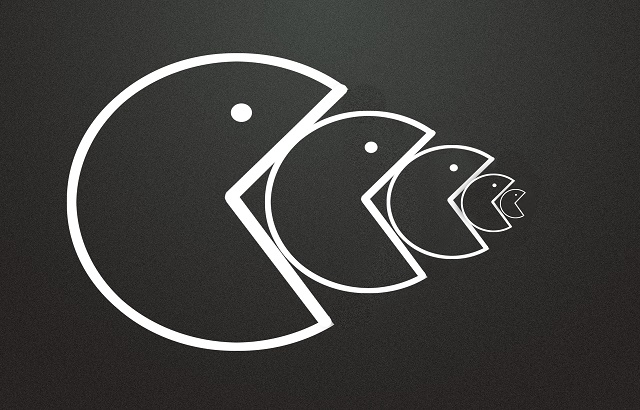

UK wealth advisory firm Fairstone has enhanced its downstream buy out (DBO) programme to give companies the potential to “effectively double the market value of their business”.

The DBO scheme allows the advice firm to partner with smaller IFAs to grow their businesses before the final acquisition.

The expansion of the programme will give firms access to Faristone’s capital to make local M&A deals, after their sale to the wealth business.

The company has also introduced a profit share scheme where both shareholders and non-shareholders can receive cash awards every five years on top of to capital payments, salary and bonuses.

According to Fairstone, the programme expansion has the potential to deliver “overall value equivalent between 12 and 18 times current profits”.

Not just M&A

Fairstone chief executive Lee Hartley said: “As a business we really believe that our offering is a partnership more than just a purchase. Allowing shareholders to maximise their long-term value is a central aspect of our DBO acquisition model. This is borne out in the firms we acquire who are exceeding their target sale values and consistently receiving consideration far above their original transaction target.

“Extending our proposition further, by supplying our partners with the capital to acquire local firms themselves, and by launching what is a very significant profit share initiative, makes us truly unique. We have the proven ability to support long-term organic growth at a multitude of levels and share the value that creates.

“As an organisation we are really investing in our partner firms and our established model allows the right type of business to crystallise value far beyond typical market multiples.

“Our proposition and the figures that underpin it really set us apart from our peers. We describe ourselves as an investor in sustainable growth, not simply a consolidator, and creating new layers of value reinforces our position as the stand-out partner for quality businesses.”

Fairstone has recently made its 50th acquisition with the purchase of Sidmouth-based East Devon Associates in February 2022.