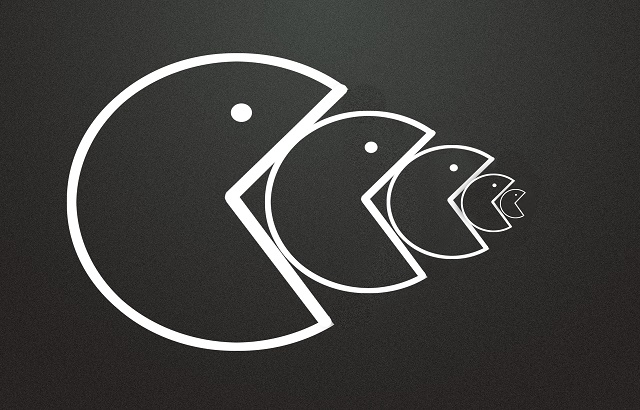

London-based IFA firm MKC Wealth has been bought by two former Quilter Private Client Advisers employees for an undisclosed sum, as part of a strategy to build a wealth management consolidator.

The management buy-in is led by Dominic Rose and Nigel Speirs, who were formerly strategy and acquisitions director and managing director, respectively, at Quilter Private Client Advisers.

The MKC Wealth acquisition is being backed by private equity firm Cabot Square Capital.

The business is set to expand through acquisitions of other firms which will be integrated into MKC Wealth, as well as through organic growth. The firm said that it is has exchanged contracts to acquire another firm, which will be announced in due course.

Rose will become chief executive of MKC Wealth, while Speirs will be executive chairman.

Barry Cunningham, the long-term owner of MKC Wealth, will remain director of client services.

Growth

Rose said: “We are going to be making acquisitions, but we will not be racing for scale like others in the sector to the detriment of these assets. We see ourselves as a smaller, client centric, alternative to the large traditional consolidators.

“Nigel and I are really excited to be working with both Cabot Square Capital and the team at MKC Wealth, as we build on their proven track record. We picked Cabot Square Capital for their expertise in financial services and for their long-term approach to investment.

“We wanted an investor that was going to be patient as we’ll only be making acquisitions where we feel there is a good cultural fit and at a sensible, sustainable pace. We picked MKC as the platform for growth because of its track record, unique culture and client focused approach.”

Freddie Athill, investment director of Cabot Square Capital, added: “This acquisition forms an ideal foundation for Dominic and Nigel’s growth strategy. They bring a huge amount of experience from their previous senior positions at major consolidators and this is the opportunity to apply that in today’s world with a high-quality starting platform and no legacy issues.

“They are totally committed to the clients and staff and have exciting plans for investing in client service based on face-to-face advice and a carefully designed technology strategy. Their approach of making all staff shareholders will underpin the culture and values that we are committed to and are fundamental to developing MKC Wealth into a market leader.”