With US markets rattled by tariff talk and heightened volatility, investors are asking what’s really going on beneath the surface. Our systematic strategies have now fully exited US equity exposure following a negative turn in the second of our two proprietary signals.

This move reflects the technical price deterioration in US equity markets over the past six weeks. At the same time, the macroeconomic backdrop seems to be rapidly weakening.

The outlook for the US economy has worsened significantly. Despite the tailwinds coming into 2025 – robust growth, hiring and investments – sentiment has made a 180° turn and will likely impact all these areas in the next six to 12 months.

The aggressive tariffs will undoubtedly hurt small companies more than large, listed ones – and small, private enterprises are the lifeblood of the US economy, accounting for over two-thirds of US employment and capex.

Given interest rates are high and credit tight, uncertainty surrounds working capital and how the price hikes in the short term will be funded. Without renewed support for consumer demand – whether through fiscal stimulus or improved real income growth – I believe the probability of a sharp and deep recession now must become the base case.

Regime shifts and market drawdowns

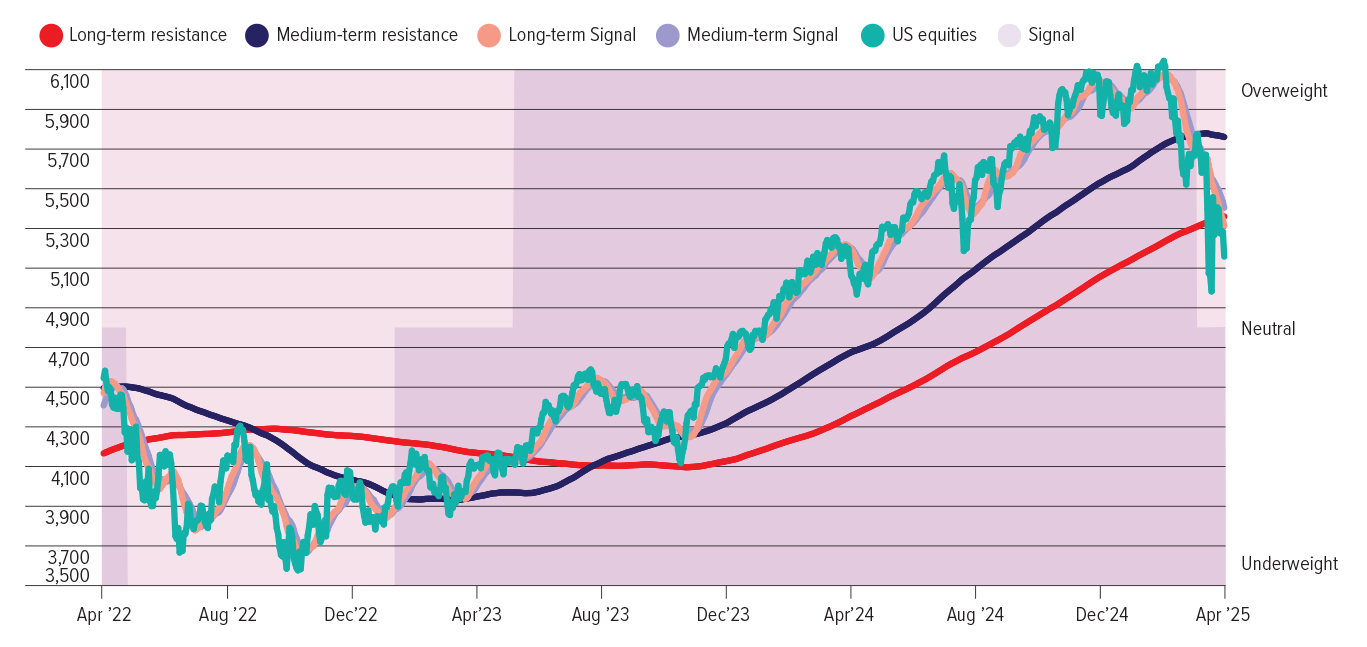

The chart below illustrates the deterioration in our signals, which have historically been effective in identifying major regime shifts in market conditions. The second signal, which recently turned negative, has not done so in over two years.

The past three years of Shard Capital’s US Equity Signal

Given valuations remain elevated relative to forward-looking earnings potential, it is clear the outlook for US equity markets is highly challenged. With tight credit conditions, margin pressure rising and topline growth slowing, an earnings recession is increasingly likely.

Despite an already significant market decline, a further correction of 20-25% should not be ruled out. Historically, this regime has been associated with major equity market drawdowns and volatile conditions across asset classes.

In light of this confluence of deteriorating signals and fundamentals, our exposure across all strategies have become significantly more defensive. However, it is worth considering it is darkest before dawn. Perhaps there is no blood on the street yet, but in volatility lies opportunity and investors should remain vigilant!

Ernst Knacke is head of research at Shard Capital

This article first appeared in the May issue of Portfolio Adviser magazine