I don’t think I’m being controversial by saying diversification should be pretty important to investors.

It limits risk and makes the experience of investing far more palatable. You spread your savings across different holdings that are doing different things and it means your future ability to buy stuff is not dependent on just one outcome.

It’s exactly what we aim to do in our Downing Fox Funds. Within our equity portfolio, we hold a mixture of active managers that is genuinely diversified by style, market cap and geography.

Sound sensible? Not according to 2024, who just called and told us we are idiots for having such whacky ideas. Screw being “diversified”, just own a handful of the biggest stocks on the planet, which are all broadly tied to the same theme, and simply ignore everything else.

AI giant Nvidia, for example, has continued its mind-boggling 2023 performance with returns of 152% in the first half of 2024. The AI hype has also meant 20% returns for Microsoft, Amazon, Meta, Alphabet and Broadcom – all of which happen to now be among the 10 biggest stocks on the planet.

See also: Premier Miton’s David Jane: No-one wants to talk about portfolio construction

I’m not saying those stocks are not deserving of good returns, their growth has been spectacular. The fact they have gone up also isn’t itself an issue, either. No, the problem is (at the risk of massively overgeneralising) all other share prices have been flat or, more often than not, gone down.

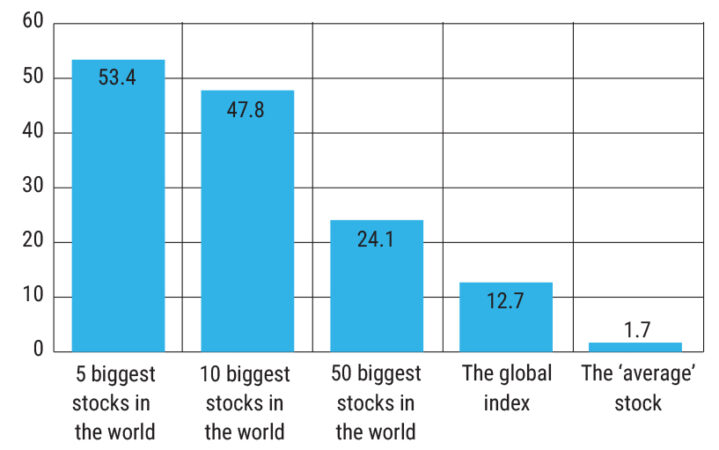

This has led to one of the narrowest markets ever. The global index has gone up 12.7% in 2024, but the average stock within it has only made 1.7%. This is because the global index is market cap weighted, so naturally has a higher weighting to the biggest companies. As you can see, the bigger the company, the bigger the return.

Percentage return in 2024

Stranger still, it means equities have just become negatively correlated with equities!

In June, the global index went up 2.8%, but the average stock within it went down 0.8%. This discrepancy in returns has only happened a handful of times – the last time it was on this level was nearly 27 years ago in December 1997.

The domination of those big stocks has not only made a mockery of the idea of being diversified, but it’s also made active equity managers rather pointless – which is a bitter pill for us, given we are strong advocates of active management.

See also: Rob Thorpe: Data is important but relationships matter

The principal reason you pay a higher fee for an active manager is in the hope they beat the market by being different to it. Otherwise, you might as well just buy a cheaper passive, which replicates the market. In 2024, the last thing you’ve wanted to be is different.

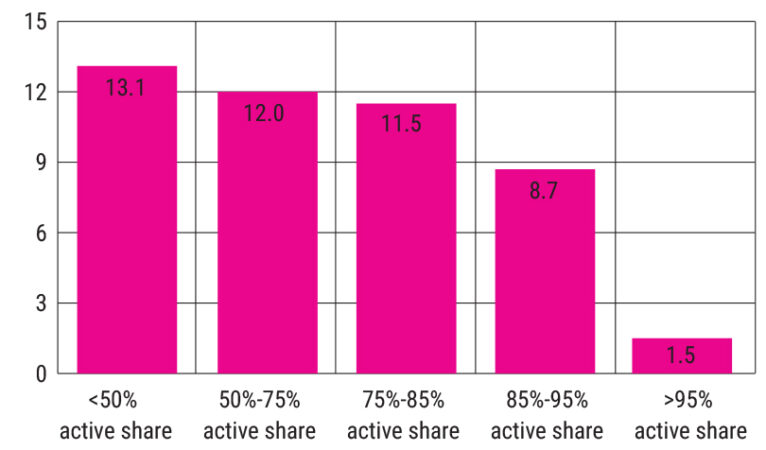

There is a clear correlation between a fund’s active share and its returns this year. For example, within the IA Global sector, the more you look like the index, the better you have done (there have been long periods where the opposite has been the case, with “closet trackers” being the worst performers and the most active being the best).

IA Global funds returns in 2024 (%) group by active share relative to iShares MSCI ACWI ETF

What does this all mean? Well, we are aware that advisers are increasingly turning to passive options within their portfolios (and why not, they are cheap and have performed well).

The problem is, many of the best-performing multi-asset portfolios of late (particularly passives) are not diversified anymore – and this is where advisers need to be very careful.

That is because indices (and therefore passives) are now the most concentrated they have ever been – and this is where the problem lies. The global index now has 72% in the US and 22% in just six companies (Apple, Microsoft, Nvidia, Amazon, Alphabet and Meta), all of which are tied to broadly similar themes.

See also: Less than half of UK investors are happy with portfolio performance

History is littered with examples of these one-way bets. Each time they have unravelled, they have caused big problems for indices, given stocks/sectors within them become such a large part of them when the going was good, therefore dragging them down when things changed.

We don’t know how long this period of mega-cap AI domination will continue, but rather than try and call markets, we focus on finding exceptional active managers and make sure we are not betting the farm on one way of investing winning over all others. This means we do hold funds that own Nvidia and co, but alongside them, we have managers who own value stocks or small-caps. Over the longer term, we think this type of strategy will deliver as markets become more rational, even if, over the shorter term, we may look a tad pedestrian.

Alex Paget is a fund manager at Downing Fox Funds