The Indian IT Services industry occupies a dominant position in the global technology services landscape, providing cost effective and scalable solutions for enterprises across the world, writes Ramesh Mantri, adviser to the Ashoka India Equity Investment Trust.

Over the last 30 years, Indian IT companies have matured from being mere outsourcing vendors to ‘strategic partners’ driving large scale transformation projects in Fortune 500 companies.

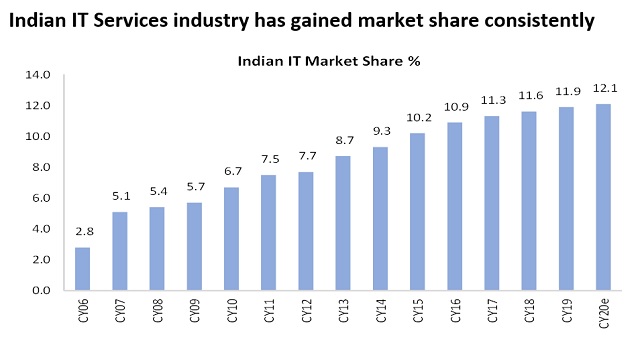

India’s IT export is $150bn annually, represents circa 12% of total global IT spend and has grown by 20% CAGR over the last 20 years.

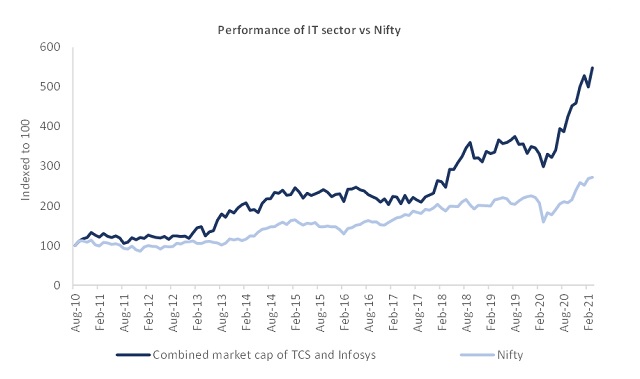

Along the way, the IT Services industry has created tremendous wealth for its stakeholders and its attractiveness is also underpinned by its superior profitability and high returns on capital compared to the broader markets.

In the initial stages of the early 1990s, policy support (in form of income tax relief) acted as a tailwind for the Indian IT Services industry. However, it was in late 1990s that these companies gained prominence by providing solutions to the ‘Y2K’ problem.

Since then they have deftly adapted to the evolving technology environment, seamlessly traversing the wide spectrum of required skillset – from mainframe/back-end oriented to digital/front-end oriented.

It is this agility which has resulted in a steady market share gain for Indian IT players in a fragmented industry – the largest company IBM has just 4% market share.

Tech refresh

The sector has not been without its share of skepticism at various points in time over the last two decades. The latest inflection point was in 2015 when the entire IT services industry was disrupted by digital transformation and adoption of Cloud.

It was feared that Indian companies were not well-prepared to make this transition and hence would lose market share to global competitors.

We, however, believe that the market under-appreciated the fact that Indian IT companies have done an admirable job at navigating this challenging business model transition by building strong digital capabilities, re-skilling their workforce at scale and making them future ready.

It is not the Tier-I IT companies alone but also the midcap companies which have displayed resilience backed by strong leadership and deep domain capabilities. In fact, through the ‘tech-refresh’ cycle of FY15-20, Indian IT companies witnessed double digit growth, led by strong traction in digital services which is now a significant part of their revenues.

For example, digital services accounts for 45% of Infosys’s revenues.

STEM talent

Today, digital services including Cloud, Analytics and AI is about 30% of the IT budget of a global enterprise and is likely to accelerate due to covid-19.

As per a McKinsey survey of global executives, digital adoption has accelerated by at least three years globally and by four years in Asia Pacific.

Also, given the rapid pace at which digital technologies are being adopted across corporate functions, enterprise IT spend decisions is not the domain of the chief technology officer (CTO) alone; but involves other CXOs (CEO, CFO, CMO, CRO CHRO) as well. This acceleration in digital transformation and its enterprise wide adoption is likely to drive new growth opportunities for the IT Services industry.

Even as the strong deal pipeline provides medium term visibility, structural factors remain intact.

India’s Stem talent by far is globally the most competitive with more than 1.5 million English speaking engineers graduating each year. India has nearly one million digital professionals, circa 20% of Indian IT headcount, possibly among the biggest talent pools globally.

Risk factors

During our discussions on the IT Services industry two aspects are often debated. One is on visa related risks which Indian companies have so far countered well by achieving a higher localisation rate and building near-shore capabilities.

The other important aspect is the flawed approach on modelling rupee growth and its impact on valuations of IT companies.

Over the long-term the rupee has depreciated by 3-4% a year, which basically reflects the inflation differential between India and advanced economies and incorporating this itself increases the value of a company by 35-40% in a DCF approach.

Apart from the above factors, we believe that there is a very supportive ecosystem with large domestic base for big data and analytics (‘India Stack’) which is also fuelling innovation and fostering high quality talent.

Indeed, in a data led global economy, Indian IT Services is well-positioned for growth.

This article was written for International Adviser by Ramesh Mantri, adviser to the Ashoka India Equity Investment Trust.