The Financial Conduct Authority’s (FCA) retirement income market data for 2021-22 shows a stark picture for the pension transfer space.

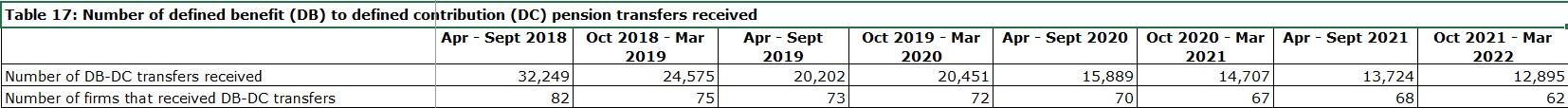

In the last tax year, transfers from defined benefit (DB) to defined contribution (DC) schemes dropped to 26,619 from 30,596 in 2020-21.

Similarly, the number of firms that received a DB transfer fell from 63 to 57.

This fall is part of a declining trend since 2018, FCA data shows.

In the 2018-19 financial year, 56,824 DB to DC transfers took place – 53.2% more than what was carried out in 2021-22 – and a total of 160 firms received at least a transfer, around two thirds more than last year.

Source: FCA Retirement income market data 2021/22

David Brooks, technical director at independent consultancy Broadstone, said: “The fall in DB transfers is the culmination of a number of factors including the limited availability and increased cost of advice that has come about since contingent charging was banned, falling transfer values and a shrinking pool of retirees with DB pensions.

“However, we have continued to see transfer advice made readily available where trustees are taking a proactive role in the provision of advice and guidance to those members approaching retirement.

“In these scheme-run exercises, trustees are able to upgrade their retirement processes to improve education and outcomes for members while benefiting from economies of scale when accessing IFA advice.”