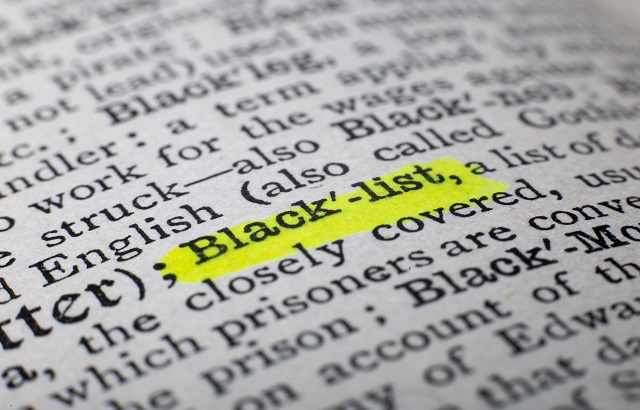

The European Council has updated the EU’s list of non-compliant jurisdictions for tax purposes.

While there has been some reshuffling with countries being taken off and others added, 12 jurisdictions are on the list, the same number as in the last update.

Specifically, the Cayman Islands and Oman are no longer deemed as either non- or partly compliant with international standards.

The Council said: “Cayman Islands was removed from the EU list after it adopted new reforms to its framework on Collective Investment Funds in September 2020.

“Oman was considered as compliant with all its commitments after it ratified the OECD Convention on Mutual Administrative Assistance in Tax Matters, enacted legislation to enable automatic exchange of information and took all the necessary steps to activate its exchange-of-information relationships with all the EU member states.”

The Cayman Islands was added to the list during the last review in February 2020.

‘Progressive regime’

Jude Scott, chief executive of industry representative organisation Cayman Finance, said: “The EU’s recognition of the Cayman Islands as cooperative on both transparency and fair taxation is an important validation of Cayman’s commitment to a responsible policy of tax neutrality that poses no harm to other countries.

“The EU now joins many other respected international entities like the OECD in identifying the Cayman Islands as a transparent jurisdiction without harmful tax regimes. We greatly appreciate the Cayman Islands government’s cooperation and working relationship with the EU over many years that helped produce this outcome.

“Cayman Finance and the Cayman Islands financial services industry actively support the Cayman Islands government’s efforts to ensure our tax neutral regime remains progressive, continuing to meet the highest evolving global standards on transparency and tax information sharing.”

Not so lucky

But Anguilla and Barbados cannot say the same, as they were added to the latest draft.

The Council explained that the two jurisdictions were considered non-complaint and partly compliant, respectively, following “peer review reports published by the Global Forum on Transparency and Exchange of Information for Tax Purposes”, which found the countries were not meeting the international standards for transparency and exchange of information.

The countries that feature in the updated list are American Samoa, Anguilla, Barbados, Fiji, Guam, Palau, Panama, Samoa, Seychelles, Trinidad and Tobago, the US Virgin Islands and Vanuatu