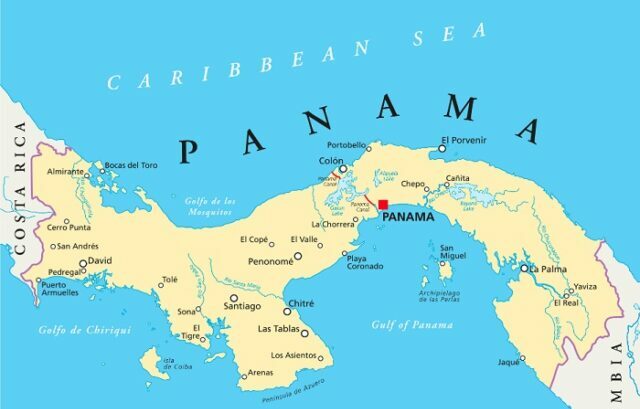

Tax pariah Panama introduces fresh anti-avoidance measures

The controversial central American jurisdiction is poised to toughen its tax fraud penalties, a year and a half after it came under worldwide scrutiny for the Panama Papers leak.

The controversial central American jurisdiction is poised to toughen its tax fraud penalties, a year and a half after it came under worldwide scrutiny for the Panama Papers leak.

The European Council published its blacklist of 17 non-cooperative jurisdictions on Tuesday, including the United Arab Emirates and Bahrain.

Incoming Requirement to Correct (RTC) rules “are a potential breach of human rights” according to James Quarmby, a top private client tax lawyer.

One of the UK capital’s super-wealthy hotspots is canvassing residents to see if they would be willing to pay double tax after one group came forward asking to pay more.

The UK needs to treat its whistleblowers better, according to a law firm which unearthed Financial Conduct Authority data.

Commercial property tax changes could lead to a UK non-dom exodus, international law firm Withers has warned.

Telling clients about all the risks involved in an investment makes it appear less risky and more attractive, a study has found.

Jersey and the Isle of Man have topped the Organisation for Economic Cooperation and Development’s compliance table for the exchange of tax information.

Offshore tax evaders face “much higher” penalties for non-compliance under new Right To Correct (RTC) rules revealed by HM Revenue & Customs.

The Gibraltar Financial Services Commission has agreed to stand inspectors down ahead of a new court date.

Gibraltar’s financial regulator has called on STM Group to “work together” after the firm ordered lawyers to block a probe into potential failings at the firm.

Estate dispute experts at Irwin Mitchell Private Wealth are predicting a rise in burial disputes as family arrangements become increasingly complex, even in later life.