Eastspring establishes onshore presence in China

Eastspring Investments has joined the growing list of foreign asset managers who have set up an investment management wholly-foreign owned enterprises (IM Wfoe) in China.

Eastspring Investments has joined the growing list of foreign asset managers who have set up an investment management wholly-foreign owned enterprises (IM Wfoe) in China.

Sanlam will take full control of Morocco’s Saham Finances for $1.05bn, and is actively looking for other acquisitions that will make it “number one, two or three” in the markets in which it operates.

Insolvent discretionary fund manager Beaufort Securities was given a stay of execution by the UK regulator to allow the Federal Bureau of Investigation to finish its undercover operation, it has been revealed.

A “staggering” $172bn in Chinese funds have been deposited offshore by non-bank institutions in just three years, according to a report by Knight Frank.

Blackrock has defended itself against charges from a parliamentary select committee that it was “schizophrenic” in its holdings of Carillion, taking both long and short positions.

It is now less than a year until the Isle of Man Conduct of Business Code comes into force, International Adviser spoke to several firms headquartered on the island to see how they are preparing for the introduction of the regulation.

South African taxpayers have fessed up to unauthorised foreign assets and income worth ZAR3.3bn (£200m, $278m, €224m), some with links to the Panama Papers, under the country’s special voluntary disclosure programme (SVDP).

Aviva Asia will launch a Hong Kong joint venture in the first half of 2018, as the group shifts its investment focus to high growth markets.

The wealth division of Credit Agricole has launched a big push into Spain with two new offices and senior recruits who all join from Deutsche Bank.

Health insurer Cigna Corporation is to acquire US Fortune 100 company Express Scripts for a staggering $67bn (£48bn, €54bn).

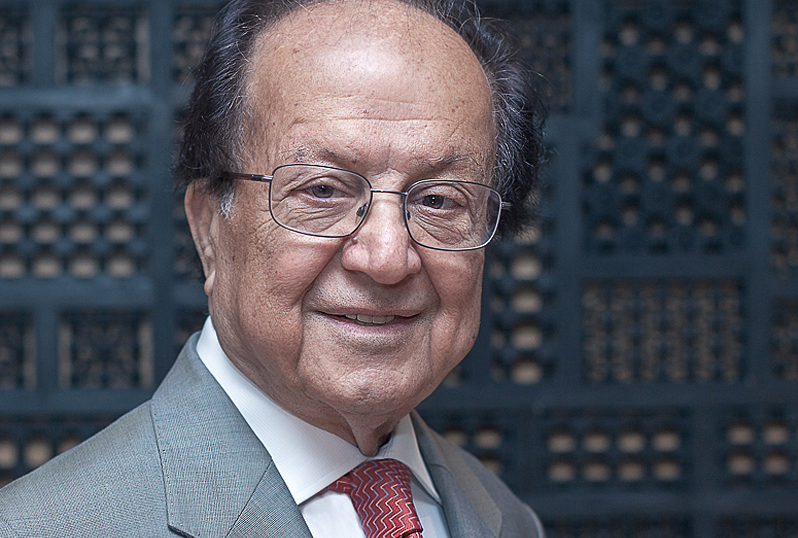

The former governor of the Dubai International Financial Centre (DIFC) and chair of the Dubai Financial Service Authority (DFSA), Abdullah Mohammed Saleh, has died.

A financial adviser who funded a lavish lifestyle from investments in an unauthorised collective investment scheme has admitted perverting the course of justice.