CBA’s wealth management spin-off surprises market

The Commonwealth Bank of Australia (CBA) is to de-merge its wealth management and mortgage businesses and undertake a review of its general insurance business, with a view to potentially selling it.

The Commonwealth Bank of Australia (CBA) is to de-merge its wealth management and mortgage businesses and undertake a review of its general insurance business, with a view to potentially selling it.

Insurance giant Anbang is entirely under government control after the country’s regulator confirmed it has seized over 98% of the formerly privately-held conglomerate.

Eastspring Investments is looking at ESG and China-focused multi-asset products and adding people to its investment team, according to Colin Graham, Singapore-based chief investment officer for multi-asset solutions.

Socially-responsible investing is not about short-term gains, says Union Investment’s sustainability chief Florian Sommer, it’s about divining future business trends and working out which companies are best able to adapt.

Negative headlines have done little to help managers make investing in Africa an attractive proposition, but the sheer size of the continent and the opportunities on offer mean it is worth taking a second look, says Ashburton Investments’ Paul Clark,

Vanguard fills its newly created head of Italy position, Martin Currie sets out its succession plan involving a Blackrock alum and PSG Wealth grows its Johannesburg office.

More China-based asset managers are expected to internationalise and target European investors, according to Alessandro Silvestro, Hong Kong-based managing director, Asia Pacific, at Lemanik Asset Management.

More than 120,000 people in Asia Pacific have registered to sit CFA Institute exams this month, representing 53% of the record-breaking global intake.

Troubled Hong Kong financial advice firm Convoy Global is being sued by one of its biggest backers in an attempt the halt the sale of shares in another company at a substantial loss.

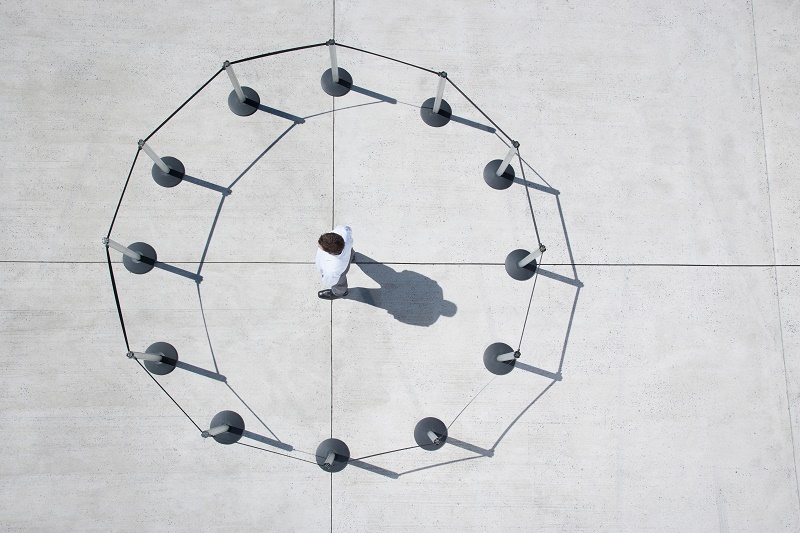

With the vertically-integrated advice model under fire and the cost of financial advice being more than the average Australian is prepared to pay, could a UK-style tied model be the solution?

Wealth managers should go beyond a pure functional role and work more on the personal connection with high net worth clients, according to David Wilson, head of Asia wealth management at the consulting firm Capgemini.

Major Australian bank Westpac could face multi-million dollar fines after the country’s financial services watchdog commenced legal proceedings against it over allegations of poor financial advice provided by one of its former employees.