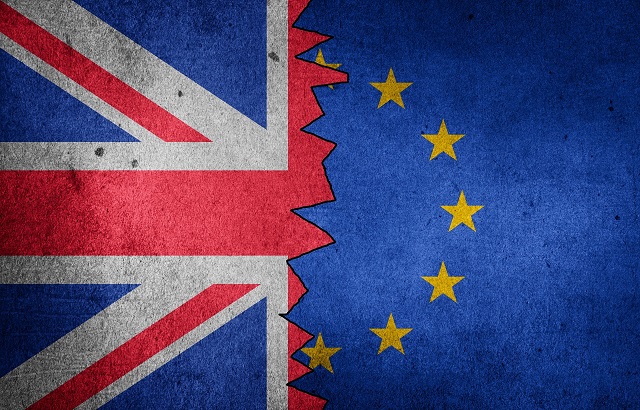

The European expat financial market has been quiet for the last few years. The sector was expected to be destroyed with the UK’s decision to leave the EU.

But according to expat advice group Blevins Franks, business has been booming despite Brexit.

John Simmonds, chief executive at Blevins Franks, told International Adviser: “Five years ago, a lot of people did say whether we would exist post-Brexit. Fortunately, things have grown and grown. The reality is that people have always moved abroad even before the UK was in the EU.

“We’ve had to make a lot of changes post-Brexit with regulation and compliance, which took a lot of doing. We’re regulated in every country individually and we had to move the centre of our compliance into Europe, although we still have the UK-regulated business as well.

“But in terms of clients, we’re now dealing with more inquiries than we ever have, and a lot of that is driven through the internet. This year we’ve got back on the road with seminars, and we’ve opened some new offices in the last two years. There’s a lot of demand for people moving to the European countries that we’re in.”

Brexit complications

Brits may not be deterred from retiring or moving to EU countries due to Brexit, but that doesn’t mean it hasn’t caused more difficulties than clients expected to face before the decision to leave the EU.

Simmonds said: “Because of Brexit, clients have to sort themselves out before they go because of visas and other complications. We set up an immigration service that helps people plan when they’re going abroad. People have to think a bit more in advance before they go than they used to.

“We’re seeing a catch up of people who live in a country that we’re dealing with. We’re dealing with more people inquiring, and they tend to be thinking now a bit further in advance because of the visas. People are now looking two years ahead of their retirement and move to Europe.

“The other thing that has probably changed post-covid is that some people have decided to move abroad because they can work from there remotely. Some people have also decided to retire a bit earlier than they thought. The other issue that we weren’t expecting is that, post-Brexit, a lot of existing UK IFAs and banks have realised that they don’t want to advise people in Europe, or they can’t.

“At a lot of our seminars, we had a lot of people coming who have been living abroad for a few years, and suddenly found they couldn’t access the advice they used to get. Some of the institutions weren’t ready for Brexit, as they thought there was going to be a deal between the UK and EU on ‘equivalence’. But, of course, nothing happened.

“I think we’re getting to the point now, so long after Brexit and the deal, that people are being told ‘we can’t deal with you anymore’.”

Retirement decisions changing

Covid has been a big factor in many people’s decision making.

Some people have thought about retirement more and making time to spend with their families.

Simmonds added: “We’ve seen slightly younger retirees. Previously, the average age of a client that came to us was around 60, we’ve noticed people in their mid-50s thinking about retiring abroad.

“I think slightly younger clients are retiring a bit earlier, but they also want different things. People don’t necessarily now want to just retire to where the sun is and there’s a golf course.

“We’re starting to see some demographic change where people don’t just go to the sunny places.

“We monitor very closely with heat maps where all the inquiries are coming from, so we’ve noticed more people are starting to retire to cities. We expect that to continue because of the wealth transfer between generations and the demographic changes.”

Future

Blevins Franks is not looking to rest on its laurels. Organic and inorganic growth is on Simmonds’ mind.

“We’re not a volume business,” he said. “We have around 60 advisers. The next stage is to move up to about 70 advisers across Europe. I’m not after hundreds of people.

“I do also look for acquisitions, but you’ve got to find the right quality. There are not a lot of businesses like us in Europe.

“We bought our biggest competitor in France many years ago. A lot of the other models are more networks. But we’re always on the lookout.”