It’s a truism that for investment professionals, financial markets are full of opportunities whatever the economic conditions. It’s a matter of looking in depth at where the value can be found, then taking a patient, long-term approach and being willing to ride out bouts of short-term volatility.

2022 was an annus horribilis for bond investors as most fixed income assets delivered double digit losses. Yields peaked in mid-2023, opening up opportunities to add bonds back to multi-asset portfolios. Moving to 2024, we have seen bonds sell-off once again as economic growth and inflation surprise on the upside and the probability of interest rate cuts recedes.

So it feels like an appropriate time to consider what lies behind this resurgence, and assess where we’re likely to be heading with bonds as 2024 unfolds.

An attractive return to favour

In essence, the pivot between bond prices and yields has shifted, and bond yields are currently very attractive relative to recent history. In my role at Morningstar Wealth, my investment management colleagues and I are privy to in-house deep research and analysis supporting the view that expected overall returns for 2024 will be higher than previous years, with one of the reasons being this raised bond yield environment.

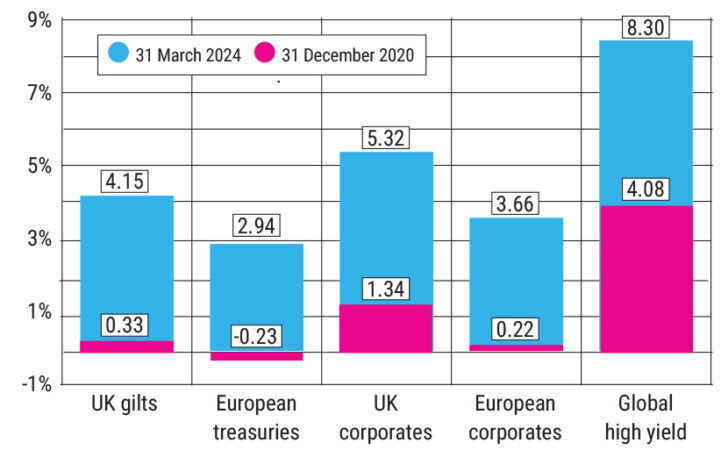

Let’s look at this in a useful chart:

Bond yields are very attractive relative to recent history

You can see that bond yields are looking significantly more attractive than they were in 2020 amid the Covid disruption. The uptick in bond yields has increased their attractiveness compared with other assets. This particularly applies to the UK, US and Australia, where yields now exceed long-term inflation expectations in many cases and thus offer positive or real yields.

All things being equal, by holding a bond until maturity these latest percentages indicate the level of income and return the investor will potentially receive over the lifetime of that investment.

Moreover, not only are yields higher, the sensitivity of bonds to interest rate movements has declined. This is a technical feature of bonds called convexity, which means bond prices are less sensitive to changes in interest rates when yields are higher. Simply put, bond investors will suffer more muted losses in the event of an inflation surprise, and the double-digit losses that took place in 2022 are highly unlikely to be repeated.

This means the risk-reward skew is beneficial for investors in bonds. So we can see a lower probability for losses, and if we do get a more benign inflation environment, and the Bank of England and other central banks start cutting interest rates, bond yields will of course start moving down leading to attractive returns.

Bonds perform an offsetting role

We do see some risks ahead that, while providing potential opportunities in the market, should also be offset by bonds, as indicated in this table:

| Risk | Impact | Nature of risk | Potential opportunity | Offsetting positions |

| China/US conflict | Rapid reshoring, global economic uncertainty | Global equity volatility | Latin American equities | Long-term, high-quality government bonds |

| Hard landing/recession | Unemployment rises, falling corporate earnings | Global equity volatility | Defensive equities: utilities, healthcare | Long-term, high-quality government bonds |

| Resurging inflation | Higher interest rates, falling corporate earnings, heightened recession risk | Equity and fixed income volatility | Inflation-linked bonds | Short-term, high-quality government bonds and short-dated investment grade bonds. |

The key is to focus on good quality bonds. Exposure to government bonds looks preferable for longer maturities. Corporate bonds are priced for a slowdown rather than a recession, so shorter maturities make more sense in this instance. Balancing the duration of different fixed income assets is eminently sensible.

Corporate bonds (investment-grade or high yield) do offer higher yields than government bonds, as they entail greater credit risk, and so are useful as a middle ground option; their extra yield compared with government bonds along with shorter duration can assist with balanced portfolio construction.

Looking at bonds, the key risk with fixed income instruments is that the current level of interest rates doesn’t sufficiently slow economic growth and inflation. Therefore inflation-linked bonds appear reasonably cheap insurance and have a role to play in the investment mix.

Our approach to fixed income investing is to look beneath the bonnet to create a conviction score anchored around what the fair return/fair value is for that asset class. What emerges from this exploration, benefitting from the breadth of our global research and analysis expertise, is solid ground on which to prepare for the market conditions in the months ahead. As always, taking a long-term view overall and retaining a diversified portfolio are the best guard rails in investment management.

Mark Preskett is senior portfolio manager at Morningstar Wealth