BlackRock and Jio Financial Services (JFS) have formed a pact to launch a 50:50 joint venture to enter India’s asset management industry.

BlackRock said that the JV brings BlackRock’s expertise in investment management, risk management, product expertise, access to technology and scale among other things, along with JFS’ local market knowledge, digital infrastructure capabilities and robust execution.

JFS and BlackRock plan to invest $150m (£115m, €135m) each in the JV – but they said both firms may invest more into the joint venture. Its launch will occur following regulatory sign-off.

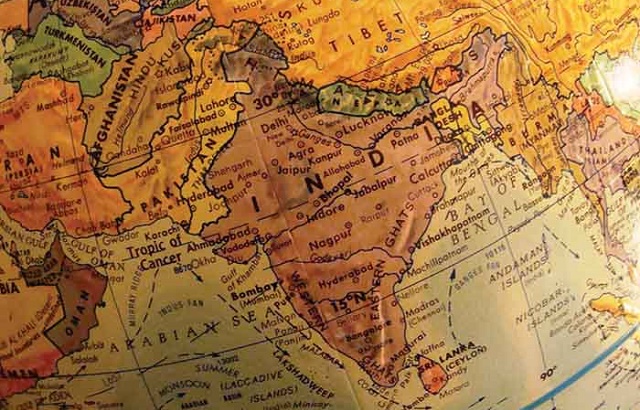

“India represents an enormously important opportunity. The convergence of rising affluence, favourable demographics and digital transformation across industries is reshaping the market in incredible ways,” said Rachel Lord, chair and head of Apac at BlackRock.

“We are very excited to be partnering with JFS to revolutionise India’s asset management industry and transform financial futures. Jio BlackRock will place the combined strength and scale of both of our companies in the hands of millions of investors in India.”

“This is an exciting partnership between JFS and BlackRock, one of the largest and most respected asset management companies globally. The partnership will leverage BlackRock’s deep expertise in investment and risk management along with the technology capability and deep market expertise of JFS to drive digital delivery of products,” said Hitesh Sethia, president and chief executive of JFS.

“Jio BlackRock will be a truly transformational, customer centric and digital-first enterprise with the vision to democratise access to financial investment solutions and deliver financial well-being to the doorstep of every Indian.”

For more insight on asset and wealth management in Asia, please click on www.fundselectorasia.com