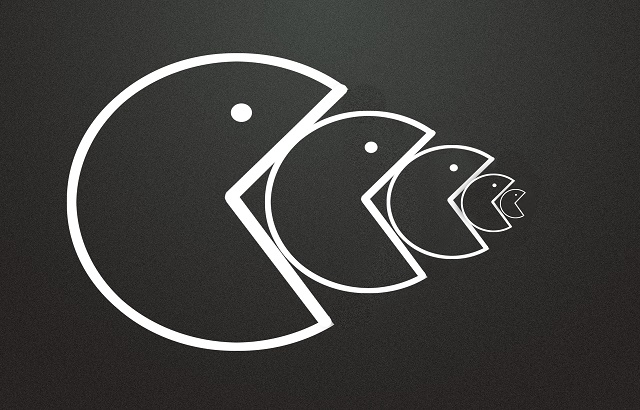

The economic slowdown triggered by the coronavirus, the longer than expected lockdown and a set of regulatory measures have made it challenging for smaller advisory firms in the UAE to stay afloat, rendering many either takeover targets or closedown candidates.

In any case, big time consolidation is in the offing.

“Of course, the advice market in the UAE is ripe for consolidation,” said DJ Sengupta, managing partner, Capstone Insurance, Dubai.

“It has been for some time. However, I feel that there will be more and more small players wanting to merge with bigger players who are future ready.

“These large firms which have invested heavily in technology and have the ability to scale up quickly will be able pick and choose from a plethora of small firms.”

Krishnan Ramachandran, chief executive of Barjeel Geojit Financial Services, Dubai, added: “How the market consolidates is anybody’s guess.

“Artificial intelligence, data analytics, etc, will play a major part going forward. We may see new entrants, disruption models and more broad based investment strategies emerge in the near term.”

Business disruption

Historically, in any market, consolidation is triggered by regulatory measures. The UAE is no different.

Advisers have been complaining that the life insurance watchdogs are over-regulating the market by capping the commission and other fees, which should generally be based on the commercials of the contract and the role played by the advisers.

Major business disruption is expected once BOD49 is implemented.

“The regulations will bring in consolidation in the market, as only those who are committed to the UAE market for longer term would remain,” said Anand Singh, senior associate in the insurance and reinsurance practice at law firm BSA Ahmad Bin Hezeem & Associates.

“Consolidation or no consolidation, this is a good time to re-align their business and prepare better for the change,” he added.

Upfront commission

The UAE’s new rules on upfront commission, fees and mis-selling have long been expected to be a big catalyst for industry consolidation and elimination of smaller players.

It was thought that M&A activity would accelerate beyond what was seen in 2019, especially as April 2020 was the go-live date for BOD49.

The unexpected covid-19 outbreak and the long lockdown have upset all plans and a new effective date for the regulation is yet to be determined.

But even before the UAE Insurance Authority announced the cap on all fees and payments to brokers and independent financial advisers for life insurance policies and investment products, a sort of consolidation was happening in the UAE’s financial services industry.

It is believed that up to 80% of smaller advice firms could exit the market.

“The lockdown-induced slowdown in the economy will prove to be a catalyst as many small time advisers are struggling to survive,” said Sajith Marakar, managing director, Consolidated Services Bureau, surveyors based in Abu Dhabi, UAE.

“A recession-like situation has robbed many well-paid jobs and dried up income streams and people were left with no funds for investing, thus investors started shying away from an uncertain market.”

“Here, investment advisers have little role.”

Dwindling benefits

BSA Ahmad Bin Hezeem & Associates’ Singh added: “So far, pure protection products such as term policies only provide an indemnity linked to the life of the insured, but no other cash value return.

“Under the new regulations, the commission limit for such policy is capped at 10% of the annual premium, but with an overall cap of 160% of the annual premium across the life cycle of the product.

“For savings and investment products, which have a cash or return value attached to them, the cap limit is a combination of the cap limit for the insurance portion of the premium and the investment portion of the premium.

“This means that advisers cannot continue to benefit from an unregulated market and now they have become accountable, but unprofitable.

“The revolutionary regulations address issues related to mis-selling, upfront payments, overall unspecified commission payouts, fees and charges associated with investment products.

“This will redefine the way advisers conduct business,” he added.